2024

January-2024

Understanding the property market’s rhythm and cycle is extremely beneficial to property developers so you can plan the best time to deliver projects and maximize profits. Knowing when the market will likely boom or go bust can help you ride out the cycles and endure over the long term.

January-2024

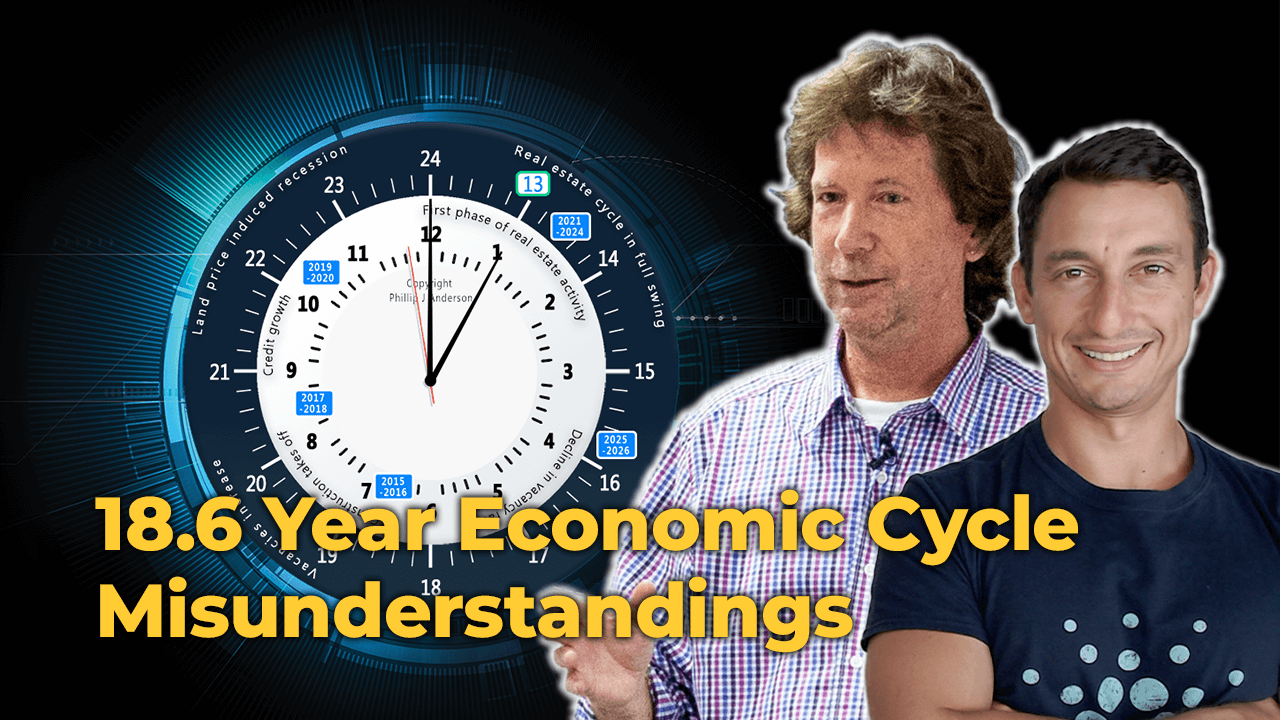

Phillip J Anderson returns to Cycles TV, this time with Akhil Patel, to discuss the 18.6-year real estate cycle, how it affects the markets, how it can transform your investing strategies, and more.

2023

October-2023

Phillip J Anderson and Greg Owen from GOKO Group had an intriguing discussion about the property predictions based on 18.6 years real estate cycle.

October-2023

Phillip J Anderson returns to Cycles TV, this time with Akhil Patel, to discuss the 18.6-year real estate cycle, how it affects the markets, how it can transform your investing strategies, and more.

June-2023

Phil and Jason discuss what’s currently happening and about to happen this decade, exclusively done from HQ.

January-2023

Phil caught up with FSC Board Member, Andrew Pancholi, to discuss the 18.6-year estate cycle seen in Western economies. A special episode of Cycles TV, The FSC’s Market Forecast 2023.

2022

December-2022

In this podcast video, Phil and Jonathan discuss different issues that happened in November 2022.

December-2022

Phil and Akhil sat down to answer your burning questions from the Twitter-verse.

December-2022

Phil has an in-depth conversation with Adam Gower about the stock market and how to predict and react to it.

November-2022

Phil and Jason have an updated discussion about the economic collapse speculations and the possibilities that can happen in the middle of World War.

October-2022

Phil and Jason have an update conversation on the recent events and their correlation to the 18.6-year real estate cycle.

May-2022

Phil and Jason discuss the 18.6-year economic cycle in 2022 and why it’s impossible to have a recession this year.

January-2022

In this last part of the podcast series with the Shepheard-Walwyn Podcast, Phillip J. Anderson discusses more about the future and what we can predict of the cycle.

2021

December-2021

Phillip J. Anderson is back to an interview in this part three of 4-part podcast series with the Shepheard-Walwyn Podcast. This time, Phil discusses the Great American BBQ, where the USA was parcelled up and sold off to the highest bidders.

December-2021

Phillip J. Anderson is back to the interview with the Shepheard-Walwyn, where he discusses more details of The Secret Life of Real Estate and Banking book.

November-2021

In this interview hosted by Greg Owen from the GOKO Group, Phil shares his forecasting of the next major peak and crash according to the 18.6-year economic cycle.

November-2021

Phillip J. Anderson talks about The Secret Life of Real Estate and Banking in the Shepheard-Walwyn Podcast, hosted by Jonathan Brown.

June-2021

Read Fred Harrison’s interview with The Daily Mail about how many persons incorrectly predicted that house prices would fall amidst the pandemic while Fred predicted otherwise.

April-2021

Phillip J Anderson and Akhil Patel spoke with Ben Everingham from Pumped on Property. They got right to the heart of what’s going on right now in terms of the 18.6-year economic cycle.

2020

October-2020

Phil caught up with Martin North to discuss how to spot the right patterns that can easily predict the property cycle.

March-2020

In this brief video, Phillip J Anderson, Economic Consultant and Author, breaks down how these cycles occur and when we can all expect the next downturn to appear.

February-2020

Akhil and Phil sat down to discuss a wide range of topics and answer some questions on the Facebook Live event.

2019

June-2019

Hosted by Nic O’Connor from Southbank Investment Research, Phil and Akhil talk about the events connected to the 18.6-year cycle.

2015

June-2015

Here is an example of what you were told to do after the last ‘crash’ and economic slowdown. Fear sells. And how wrong it was. We are all still here and the best economics to know remains what your writers at PSE always instruct: study the land market.

2014

June-2014

Read Phil and Akhil’s highly prescient June 2014 cover story for the UK’s largest financial magazine, MoneyWeek.

2013

November-2013

Learn how knowledge of cycles and time can prepare investors to take advantage of the bull run and avoid the bearish market turns.

September-2013

Read Akhil & Phil’s email from 29th of September 2013 to EIS subscribers which includes a forecast high in 2019/2020 – a full 7 years before it happened!

2010

August-2010

Phil wrote about understanding the bottom of a real estate cycle and precisely forecasting the next one. Phil quotes a line from Winston Churchill as a prelude to this article, “The farther backward you can look, the farther forward you can see.”

February-2010

Read Steve Hanke’s article in Globe Asia about the 18-year real estate cycle and recommend Phil’s book The Secret Life of Real Estate and Banking for a full treatment of the 18-year real estate cycle.

January-2010

Read Phil’s article in the International Federation of Technical Analysts (IFTA) Journal about the 18-year real estate cycle scientific foundation and its relation to current events.

2009

February-2009

Written by Teh Hooi Ling in Singapore Business Times, Phil calls bottom in 2010, based on the 18-year cycle seen in the US.

2008

November-2008

A letter from Fred Harrison in response to Scot Young’s challenge about the forecast of the current crisis.

October-2008

Read Phil’s article on MoneyWeek, explaining how to know where we are in the current financial cycle. Phil states the secret is all in land prices.

October-2008

Ross Clark writes an article in Spectator Business about Fred Harrison’s Boom Bust: House Prices, Banking, and The Great Depression 2010.

2006

May-2006

Read Michael Hudson’s article in Harper’s Magazine about how people were trapped by the Real Estate Bubble and a guide to the coming real estate collapse.

2005

March-2005

Fred Harrison wrote his argument for an economic prognosis for homeowners. Harrison warned house hunters that they were standing on the cusp of a negative equity trap.

2001

November-2001

Read a brief 2001 update from the EIS vault where Phil talks about the potential of US v China conflict and the influence this has on commodity prices and military spending.

1997

October-1997

Published in the American Journal of Economics and Sociology, Fred E. Foldvary wrote The Business Cycle: A Georgist-Austrian Synthesis. The Geo-Austrian synthesizes a theory of the business cycle with more explanatory depth than conventional theory.

SIGN UP FOR FREE