The Economy’s Hidden Cycle

The Economy’s Hidden Cycle

Imagine if you possessed an investment guide to the future, one based on the economy’s hidden cycle which has been repeating like clockwork for over 200 years?

How much of an advantage would that be for your wealth? You could benefit from the good times, yet remain safe during the difficult times.

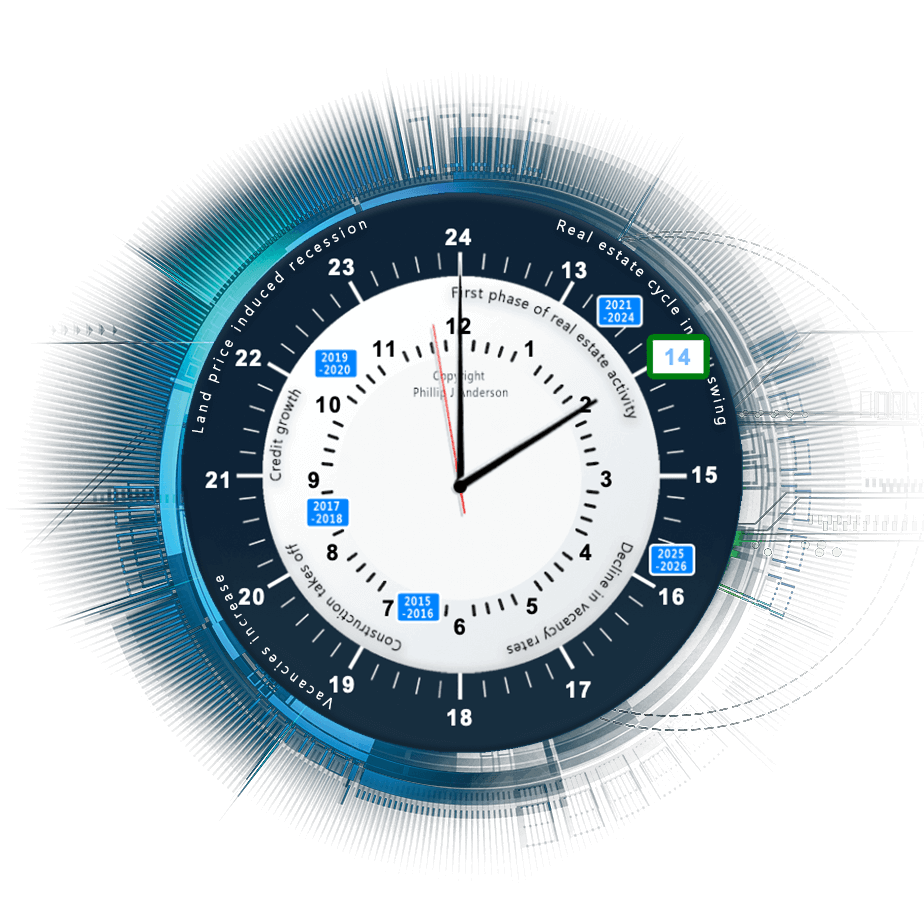

When you understand the 18.6 year economic and property cycle what appears to be a chaotic world suddenly becomes clear.

Imagine if you possessed an investment guide to the future, one based on the economy’s hidden cycle which has been repeating like clockwork for over 200 years?

How much of an advantage would that be for your wealth? You could benefit from the good times, yet remain safe during the difficult times.

When you understand the 18.6 year economic and property cycle what appears to be a chaotic world suddenly becomes clear.

The Power of Understanding

Gain the ability to predict booms and busts in advance. Make strategic decisions that help to build your wealth over the long-term. Protect your assets during major downturns.

Gain confidence that you can master your financial destiny .

Become a Property Cycle Investor member to access these benefits:

Weekly newsletter, delivered straight to your inbox

Free primer on the 18.6 year economic cycle

Free guide to our proprietary Property Cycle clock

Exclusive access to all our published e-books

Early notification about all PSE team interviews

"Phil's work with regards to the cycle and Gann analysis has been on point for the decade that I've followed him obviously, a decade prior as well. If you're interested in learning how to invest full time and understand the cycles and make the most out of investment, I highly suggest following Phil Anderson."

Jason Pizzino | Director of TIA Crypto & Crypto YouTuber

"PSE is one of the most important resources that I use to understand the markets. The insights and information help me formulate better decisions with more confidence. Any investor needs to understand what moves the markets and I have found PSE to be one of the most thought-provoking and refreshingly insightful sources of information (rather than opinion) out there."

AdaPia d'Errico | Principal at Alpha Investing & Co-Founder of Womxn of Wealth

"After I heard the Property Sharemarket Economics team speak in 2019, I got my mum and dad out of the sharemarket. That meant they protected the capital they built up and completely missed the sharemarket panic in 2020."

Ben Everingham | Director of Pumped on Property

"I am a huge Phil Anderson fan, he does not have all the BS like many other speakers. Look, Phil Anderson is one of the most accurate and correct economists and forecasters these past 2 years. When I do my research, so many of these gentleman have not done a good job with their forecasting over the past 10 years. But Phil Anderson is probably the most accurate of them all."

Greg Owen | CEO of GOKO Group

Sign up to our free newsletter

Don’t miss out on our unique take on what’s happening in the markets and economy. Access our weekly newsletter, e-books, guides and interviews packed full of valuable insights to help you make better investment decisions [for your investment journey].

Don’t miss out on our unique take on what’s happening in the markets and economy. Access our weekly newsletter, e-books, guides and interviews packed full of valuable insights to help you make better investment decisions [for your investment journey].

Media recognition of Phil and Akhil’s work

Our expertise and insights has been featured in well-known publications, adding to our credibility and reputation.

Meet Phil and Akhil

Our work is led by Phillip J Anderson, author of The Secret Life of Real Estate and Banking, and Akhil Patel, author of The Secret Wealth Advantage. Together, they have almost five decades’ experience in cycles analysis and have a proven track record in calling all of the main turns in the markets and the economy.

Phil Anderson

Akhil Patel

The Secret Wealth Advantage

How you can profit from the economy's hidden cycle

During your life you will make many important financial decisions. Their success will be significantly affected by the state of the economy and financial markets when you make them.

Imagine if you had a guide to the future to help you anticipate periods of boom and bust and make decisions accordingly: when to invest and take risk, and when to sell or take measures to preserve your wealth.

The Secret Wealth Advantage is that guide.

The Secret Life of Real Estate and Banking

Tracing the entire history of the 18-year cycle in the United States from founding to 2008, this book shows how the banking system reacts to prosperity and recession and reveals how regulations - enacted after each collapse - tend to disappear when boom times return. With its invaluable insights and practical advice, this book is aimed at both novice and experienced investors who want to know why the economy moves as it does, how it can be forecast in advance, and how to profit from this knowledge.

Sign up to our free newsletter

To master your financial destiny [make informed investment decisions], you need to understand the 18.6 year cycle based on its 200-plus years of history. Sign up now to receive our incredible insights.