If you would like to receive weekly updates like this, sign up here.

Can you guess how you could make a fortune in property by not actually buying any property?

Maybe you guessed virtual property in the metaverse? That’s a solid attempt if you did. But it’s not correct.

This week’s newsletter takes us to Canada.

And, if you buy the media’s narrative, it is home to the biggest bursting property bubble on earth!

What a story it has been for them to sink their claws into on the back of recent banking collapses in Silicon Valley.

Only…they have missed a vital clue to what is truly going on there.

And if you can put this clue together with a falling Canadian housing market it can tell you precisely where we are in the 18.6-year Real Estate Cycle.

And what’s coming next.

Sound contradictory?

What if I can show you a market where the lending market for mortgages has never been healthier while home prices are falling?

How’s THAT for contradiction!

Read on now to find out just how such a situation could occur.

And know what it means for your investments today and in the future.

The biggest housing bubble on earth just burst…. but did it?

There was always one thing that I was unable to rationalize whenever I read or heard stories, both from the professional media outlets and firsthand, about the Canadian real estate market.

Canada has a population of almost 40 million. It has a larger population than my own country, Australia, but on a global population scale, like us here, it’s a relative minnow.

However, again like Australia, it’s a first world nation with free access to the world’s financial system and a huge number of commodities that have brought many riches and wealth to the country.

Which means its real estate market represents an overwhelmingly large proportion of its residents’ wealth. The exporting and refining of these commodities, over time, eventually is reflected in gains captured by the land market.

And the Canadian banking and mortgage sector has been more than happy to make money out of the strong real estate market by writing loans secured against that same land.

Much like what has happened in Australia.

However, one news item specific to Canada has received an awful lot of airtime for more than a year now.

And that was the so-called bursting of the world’s biggest real estate bubble. According to our esteemed folk of the financial media.

From Toronto, Vancouver and Montreal to Ottawa or Hamilton, seemingly few areas of Canada were unaffected by the Bank of Canada’s rate rise campaign from March 2022 onwards.

Although denominated in Canadian dollars, the figures themselves would not look out of place in the outer suburbs of Sydney or Melbourne in Australia, even London in the UK, and New York in the US – these are traditionally some of the world’s most expensive real estate markets.

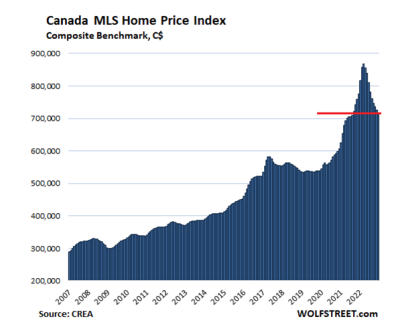

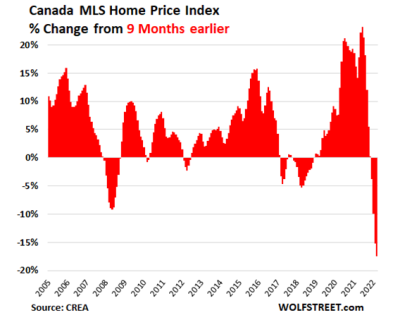

The dislocation caused by this rapid series of interest rate rises is shown starkly in the chart below.

That chart was posted in January 2023, so it is a fairly good snapshot of the damage caused.

The average home price has fallen by approximately $150,000 Canadian dollars to an average price of $717,000 dollars.

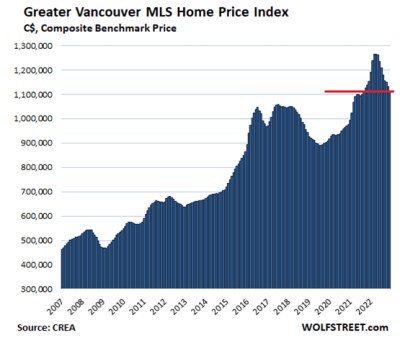

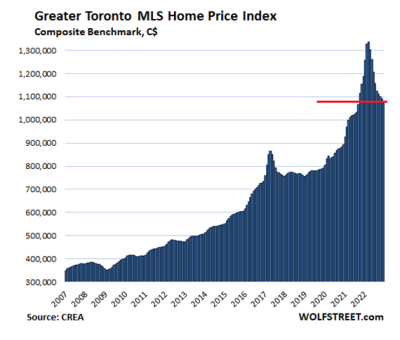

Drilling down even more, we can track the same pattern in some of Canada’s largest cities. For example, Toronto, as shown in the chart below.

The average price fell by $200,000. A similar fall took place in Vancouver.

I draw your attention to the horizontal red line on all these composite benchmark price charts. When I look at them an old investment adage comes to my mind:

“Your profits are made in the buy, not the sell”.

Think of the recent bad and negative news surrounding these markets and Canada (and you can think the same of other major cities around the world).

Then look at the homeowners they interview and the emotion they express as they come under mortgage stress and see the value of their home fall away.

Not making light of it: it’s a terrible and difficult time for these people.

But I ask you this.

When did they buy?

I’d be willing to wager that 90% of the cohort who have made up these price charts since 2007, if they were indeed sellers these last 12 months, have bagged an absolute massive capital gain.

Is it realistic to say that those who brought above that red horizontal line are the ones most affected by the falls?

If only there was someone who could have assisted them with timing their purchase?

Let’s stop there though and return to my main point above.

I said I couldn’t rationalize something to do with this busting real estate bubble.

And here it is:

If we have witnessed a legit bursting of overvalued and stretched real estate prices…

…then why haven’t any Canadian banks gone bust either?

When investing in regulations is more profitable than property.

Even I admit I was amazed when I read a recent article about the Canadian banking system. According to the article, Canada hasn’t had a bank collapse like the one witnessed in the US in 2008 for over a century!

That’s an astonishing fact, assuming the research is accurate.

I do believe though there’s some validity to it. The reason is the below headline.

Source – AFR.

The article references Canadian financier Stephen Smith. He has been described as one of the biggest winners from Canadas recent housing boom.

The thing is: he didn’t do it by buying or flipping property.

The way he did it was via a 30-years’ worth of investments in Canada’s mortgage market instead. He took on some of the US biggest short sellers and beat them at their own game.

These short sellers were betting on a huge banking crash related to an overheated property market. The fact is: it never happened.

It’s a fascinating and little understood market niche. As Stephen Smith said himself.

“My belief is it has to be a depression-type of scenario before you’re going to have any issues,” Smith, 71, said in an interview at his Toronto office.

Smith was never bullish on the value of Canada’s real estate, but the prudence of its mortgage rules.

“Mortgages that are done in Canada are really done directly or indirectly through officially regulated institutions,” Smith said. “That’s what I’ve bet on.”

Could it be that proper regulation, and the enforcement of those same regulations, have insulated lenders from the worst of the housing downturn?

The rules governing mortgages in Canada seem to bear this out.

Lenders can pursue borrowers for losses even after the underlying collateral — the home — is sold.

That means Canadians have a strong incentive to keep paying their mortgages even when things get tough. Mortgage-default insurance is typically required for borrowers who put down less than 20 per cent.

When US housing market began to crack in 2006 and 2007, Canada’s regulators gradually mandated stricter underwriting rules.

Mortgage length was reduced to 35 years from 40, and 25 for insured borrowers. The riskiest borrowers, those who put down less than 20%, were barred from continually using gains in a property’s value to refinance their loan rather than pay it off.

Ironic, as this is the bedrock of what will underpin much of the speculative lending that the real estate cycle says will be coming.

Do you remember Silicon Valley Bank (SVB)? It’s starting to fade from most people’s memories already.

SVB had a Canadian office opened during the recent bank crisis. SVB’s woes did prompt Canada’s bank regulator to take temporary control of its operations here, but those were relatively inconsequential, run out of a single office on Bay Street.

I wrote recently to you about SVB. I posit that the issues were bank specific and not a systemic crisis.

Here’s another piece of evidence supporting that.

So, if we have a sustained cooling of the Canadian house market but no sign whatsoever of any stress whatsoever on its banking system, what does it mean?

Like almost all Western countries, the effect of massive stimulus during covid meant a rising interest rate environment was needed to cool things down.

Allied to stricter regulations, this helped erase much of the post-covid gains.

Now new entrants had a lower price point to re-enter the property market, keeping the lenders happy too.

Which means the history of the 18.6-year Real Estate Cycle tells us what happens next from here.

That history lesson starts with a membership to the Boom Bust Bulletin (BBB). Give me the opportunity to take you in depth into the cycle.

Learn about the over 200-year history of the 18.6-year Real Estate Cycle and why even today it continues to repeat like clockwork.

It will teach you how to decipher the news that we get bombarded with every day to focus solely on what truly matters.

No more negativity and noise, just the science of the economic rent and the timing inherent in the real estate cycle.

This is all you need to succeed.

It is when the majority of property values fall below the value of loans outstanding against it that banks across the world suddenly have a serious problem.

No amount of stimulus or good regulation will be able to save the financial system in that case.

That time is not now.

Canada is yet another market that, rather than in crisis, has paused for breath like all property markets, primed for the next speculative rise into their respective peaks.

The set-up is unequivocal, what’s needed now is guidance to help time and profit from this rise.

And that’s how the BBB can help.

As a Boom Bust Bulletin member you will receive 12 monthly editions a year detailing all the key turning points of the cycle, a deep dive into the most important markets across the globe and ways that you can personally benefit from this knowledge.

All derived from our unique and proprietary research – which you’ll not find anywhere else.

Plus, you’ll receive exclusive invites to BBB member-only webinars when we run them

.

All this for just US $4 a month, less than a takeaway coffee.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.