If you would like to receive weekly updates like this, sign up here.

If you have read these newsletters for any length of time, you’ll be familiar with the fact the United States has led the world into and out of every 18.6-year Real Estate Cycle for over 200 years.

As things currently stand, this pattern looks set to continue.

However, there’s a chance that American leadership of the cycle may be usurped by someone else this time around.

Here’s where you yell out the word “China” in my general direction. Only thing is, I don’t think it’s going to be China.

Believe it or not, I think Saudi Arabia may be the candidate.

This country is going to be a fascinating test case for this question:

“Can Saudi Arabia alone change the timing of the current real estate cycle?”

In this week’s edition of the Property Cycle Investor newsletter, we shall examine this question.

All the ingredients to make my hunch a reality are here: massive infrastructure and development, enormous credit creation and all the usual hubris and extravagance you only get right at the peak of a real estate cycle.

And it all comes together at the right time in the cycle too.

The question is: will Saudi Arabia first demonstrate the absolute peak of the land market this time, and not the US?

And do we “actually” want this to occur?

Because thousands of innocent lives will be lost if this comes true. Thousands already have died.

Get ready to be exposed to the truly ugly side of the real estate cycle.

Inside Saudi’s Red Sea project.

On the surface, it does really look like a paradise born.

The sheer beauty and scope of this project is sure to fire up the imagination for those of you with a travel and adventure bent. Source – Al Arabyia

Source – Al Arabyia

Above is an artist’s conception of the Nujuma, A Ritz-Carlton Reserve due to open on Saudi Arabia’s Red Sea Project this year.

By the time you read this it may very well be welcoming its first tourists.

Its genesis was in the 2016 announcement by Saudi Crown Prince Mohammad bin Salman of numerous giga-projects for the country. Collectively called ‘Vision 2030’, its aim was to diversify the largest economy in the Middle East away from its historic dependence on oil.

The ambitious long-term development plan will aim to attract significant investment to the private sector, open the economy and reduce bureaucracy to attract foreign direct investment.

It also stated to increase the non-oil dependent revenues of the country from $45 billion in 2015 to approximately $266 billion by 2030.

Some of the iconic giga-projects announced as part of the Vision 2030 include the NEOM Smart City, Red Sea Resort Project, Qiddiya Entertainment City and Amaala Red Sea Riviera. But it’s the Red Sea resorts we focus on this week.

In January 2019, it was confirmed that Saudi Arabia will seek to attract $429bn in private investment over a ten-year period to fund the infrastructure drive which will include five new airports and an extensive high-speed rail network.

These funds will also pay for extensive construction of roads, railways, ports, airports, power plants, factories, mines, and supporting infrastructure.

Straight away, one can look to this as yet another example of the global infrastructure boom that’s underway. That’s because it is.

It’s a theme I’ve covered with you previously. From the US to Indonesia, Australia, and now Saudi Arabia, these projects are what’s driving global land prices higher and the expansion of credit to pay for it.

I will not labour the point. They alone confirm the real estate cycle is real and on track.

But the Saudi example stands out. That’s because the entire country basically belongs to a single family: the House of Saudi.

And what’s Saudi Arabia, prior to these announcements, famous for? Oil. Not just that, but some of the most easily recoverable and extractable fields on earth. It’s been suggested a price of $10 a barrel would mean that they can still turn a profit from exporting oil.

What’s another term we use to describe such a situation? The capture of the economic rent (oil rents) of an entire country.

This has produced undreamed of fortunes for those in the family, or closely connected to it. In fact, it has been so successful that they should probably consider doing it all again.

How so?

Well, what is less reported about these projects is the fact that Prince Salman wants to turn his country away from relying on oil revenue. He wants to see the country still be a primary exporter of oil for other nations, whilst his own diverts its own energy needs towards more renewable energy.

It’s a hedge against the world slowly weaning itself off oil.

And consider that Saudi Arabia has got, along with lots of oil, lots of desert! It’s this same desert that it intends to transform.

The Red Sea project covers 28,000 square kilometres (11,000 square miles) (an area about the size of Belgium) and will target regional and international luxury travellers.

The Red Sea coast includes an archipelago of 90 islands and the government is building new resorts in the region, as well as on the green mountains in the south near Yemen.

The development is key to Saudi Arabia’s plans to transform itself into a top tourism destination.

To help achieve its ambitious targets, the kingdom has pledged to spend billions of dollars — including on a new airline and a fresh airport. Think about what this all means for the surrounding lands once the gains from these projects begin to manifest.

Also consider the fact that these islands and coastlines are owned by Red Sea Global, created by Saudis public sovereign wealth fund. Which is controlled by…

I think you can work that one out.

Red Sea Global have already borrowed over $3 billion to start construction.

Credit creation using land as collateral is easily the best type of lending one can provide. It is this exact privatisation of what’s naturally occurring (the economic rent from productive land) and collateralizing it via speculative lending is what drives the 18.6-year Real Estate Cycle.

And its precisely why the cycle repeats like clockwork.

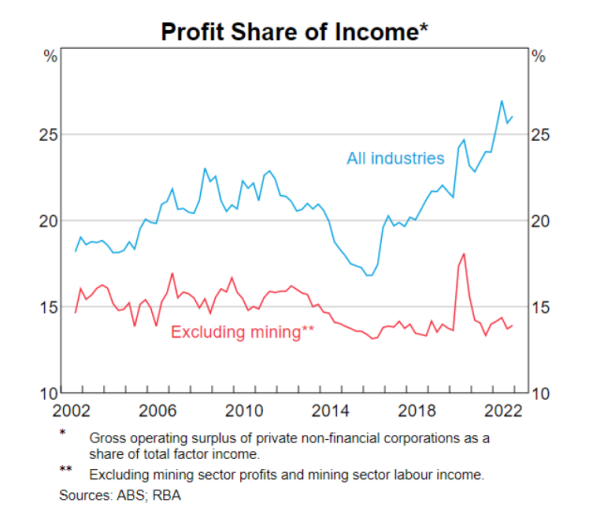

To digress a little: I’ve rarely seen a better illustration of both what the economic rent is, and why allowing the private collection (via bank lending) of that rent produces the society we live in today, than the chart below.

This chart was in a recent ABC news article with economist Ross Garnaut. In the article Ross provided a warning that by allowing a small but powerful group to monopolise the extraction of the rent, it has contributed to declining real incomes for workers, has made our cost-of-living crisis worse, and is undermining productivity growth.

Kudos to an economist to come out and demonstrate not only a strong understanding of what the economic rent is but takes the time to properly explain it. So, back to the above chart.

All you need to understand is this. The blue line shows the total operating surplus of the Australian private (non-bank) sector. This is the surplus generated above and beyond that required to undertake profitable business.

All you need to understand is this. The blue line shows the total operating surplus of the Australian private (non-bank) sector. This is the surplus generated above and beyond that required to undertake profitable business.

The red line shows the same thing minus the entire mining sector, their profits, and wages they spend on their workforce. Notice anything?

The divergence between the two lines, already wide, is now getting even wider. Here is what it tells me.

Mining companies in Australia require a government granted licence to begin mining. That government granted licence effectively turns said mining company into a monopoly that protects them from competition.

They are mining the natural resources of this country, resources that belong to everyone who was born here. Instead, it goes into private hands.

The blue line is what our society could call upon to pay for everything we could ever need. The red line is what society has left over instead.

Imagine what Saudi Arabia’s chart would look like?

Is it any wonder this entire “Vision 2030” project is nothing but capturing the economic rent of what was nothing but worthless desert.

This is why the Red Sea coastline, and its islands, are being gentrified. I also mentioned projects along the green mountains near the southern border with Yemen.

This is where the truly ugly side of the real estate cycle, and in particular the private capture and subsequent demand that government protect those licences, shows its head.

Blood money.

The war in Yemen remains the single greatest humanitarian disaster on earth. Even more so than the current conflict in Ukraine. And yet, which war do you see, hear, and read more about?

It’s the reason why, alongside the Ukrainian flag, I have the Yemeni flag on my Twitter profile.

300,000 dead, 25 million displaced. And now a deadly outbreak of cholera. Many nations are to blame here, but that level of detail is outside the scope of this newsletter.

There is however no doubt that Saudi Arabia has the most to lose outside the people of Yemen. Hence a very costly and drawn-out military campaign to push out the Iranian backed Houthi rebels.

They would call it, and they do, a war against terrorism. Let me tell you the truth.

It’s about protecting the massive projects underway per the ‘Vision 2030’ program.

This happens to be most violent example of vested interest turning to the government to protect their monopoly powers.

You see, the Houthi rebels are being armed by the Iranians. It is sadly the latest example of the Sunni/Shia rivalry between Saudi Arabia and Iran.

Some of those arms include highly advanced anti-ship cruise missiles. Along with armed suicide drones. And the rebels have used these weapons to deadly effect.

The drones have been used to launch an audacious raid on Saudi Aramco’s largest oil refinery in the country. They have also been used to hit Saudi flagged merchant vessels and oil tankers transiting the Red Sea via the Suez Canal.

Now take this one step further. What if the rebels can successfully close the entrance to the Red Sea to shipping using these same weapons unless the Saudi end their conflict? Or imagine suicide drone attacks that can reach these same Red Sea resorts.

What kind of financial and economic impact would that cause the Saudi Kingdom? Far out of context to the cost of the weapons used to accomplish it, that’s for sure.

Prince Salman’s dream would literally be in ruins.

I trust this is an angle you have probably never considered before, but here we are.

And yet, this is a system that is evident across the globe. One that allows private ownership of natural resources that belong to all.

We have to all live with it. The only way we can change this is by truly understanding the Law of Economic Rent and the history of the 18.6-year Real Estate Cycle, which perpetuates this chase. Cycle after cycle.

The best place to start is via a membership to the Boom Bust Bulletin (BBB). Give me the opportunity to take you in depth into the cycle.

Learn about the over 200-year history of the 18.6-year Real Estate Cycle and why even today it continues to repeat like clockwork.

It will teach you how to decipher the news that we get bombarded with every day to focus solely on what truly matters.

No more negativity and noise, just the science of the economic rent and the timing inherent in the real estate cycle.

This is all you need to succeed.

Look, I admit it’s a stretch to think that Saudi Arabia will mark the culmination point of the real estate cycle globally. Most likely it will still be either the US or China. But it’s not that farfetched either.

Consider this. Red Sea Global is considering a possible public market offering as soon as 2026.

“There will be some kind of public market event, whether it’s an initial public offering, whether it’s an establishment of a REIT, those are things that we’re currently studying”, John Pagano, chief executive of Red Sea Global, said in an interview in Dubai.

Note the year. It could well be the biggest REIT float in 20 years, possibly ever.

Based on some of the most over the top and extravagant hotel resorts ever created. Consider this image below of a Ritz Carlton reserve. No more hotel rooms for the ultra-wealthy.

Extravagance, over the top designs, a massive REIT public float near the top of the US land markets. All the hallmarks are here. Maybe Saudi Arabia really “will” mark the absolute peak?

If they do, please understand the continuing human cost in lives that got it there.

We can change our world with a little knowledge. By learning about the economic rent that’s naturally created we can avoid all wars and poverty. You will know precisely what issues our politicians really need to mandate.

For the good of everyone.

That’s how the BBB can help.

As a Boom Bust Bulletin member you will receive 12 monthly editions a year detailing all the key turning points of the cycle, a deep dive into the most important markets across the globe and ways that you can personally benefit from this knowledge.

All derived from our unique and proprietary research – which you’ll not find anywhere else.

Plus, you’ll receive exclusive invites to BBB member-only webinars when we run them.

All this for just US $4 a month, less than a takeaway coffee.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.