If you would like to receive weekly updates like this, sign up here.

Have you ever visited a ‘Theatre of Dreams’ before?

Well, those fortunate enough to live nearby get to do exactly that every other weekend whenever they visit Old Trafford to watch the football team Manchester United play.

Where did that term come from?

“This is Manchester United football club; this is the theatre of dreams.” So said current United director and playing legend, Sir Bobby Charlton.

Manchester United currently play in arguably the most exciting and famous football league in the world today. It’s called the English Premier League (EPL).

Huge clubs with worldwide fan bases and fame take part in this competition. Most football fans anywhere you care to ask would know who Chelsea, Liverpool, Arsenal, and Manchester City are.

And, of course, Manchester United.

Arguably though, there’s something else that threatens to make even these famous clubs become secondary. And that’s the current potential buy-out of Manchester United by two of the world’s richest people.

So, even if you aren’t a football fan, it’s this aspect of the EPL that resonates very strongly with the 18.6-year Real Estate Cycle.

Because underneath the football, every key driver that underpins the real estate cycle is also behind the fact that some of the wealthiest individuals on earth are willing to spend billions of dollars to own such clubs.

And this fact can also confirm the timing of where we find ourselves in the cycle too.

So, it’s worth our time to look at this potential sale, and what it tells us about the final few years leading to the peak of the current cycle.

United we stand.

So, what is it exactly that makes the current struggle between two separate parties to buy the club from current owners the Glazer family so important and intriguing?

Are the two prospective owners’ huge fans of the club, who want to return it to the fans and make it the centre point of the Trafford area?

Maybe. One is a Qatari sheikh named Jassim bin Hamad bin Khalifa Al Thani, of who little else is known other than that he is a son of Qatari emir. He claims to have been an ardent United follower for two decades.

The other would-be buyer is Sir Jim Ratcliffe, the billionaire chairman and CEO of INEOS chemicals group. Sir Jim once sat in the Stretford End (the famous stand in the Old Trafford stadium) to watch United home games when he was a child.

As I said, on the surface there may be a level of fandom here. But consider the following.

After the beginning of the Russian invasion of Ukraine in February 2022, all western nations were quick to freeze the assets of various Russian government officials and those associated with them.

One such individual was Roman Abramovich, the former owner of Chelsea football club and one of the world’s richest Russian oligarchs.

The British government decided he was persona non grata and forced him to sell the club. Not only that, but the proceeds of said club sale were to be appropriated by the government and distributed to a Ukrainian relief fund.

(You might question whether a government should be allowed to do this to private property? This is a conversation for another day).

What I want to focus on is that one of the bidders for Chelsea was…. United fan Sir Jim Ratcliffe! The one who is now claiming to be a superfan of the club.

This goes way beyond being a particular fan of a particular club now. Considering the billions required to buy these clubs, one must ask: what’s in it for these prospective buyers?

How do they intend to make money from this? Most EPL clubs have a wage to turnover ratio upwards of 70%. In other words, most of what clubs earn goes straight to the pockets of their registered players.

And then there’s the ongoing costs of maintaining stadia and training grounds, buying new player registrations and the rest.

The bottom line is that out of day-to-day revenue even the biggest clubs do not earn much of a surplus.

Always view events – even football – with your real estate cycle lenses.

But here is where the movie screen asks viewers to put on their real estate cycle lens.

Because it’s your knowledge of the real estate cycle that shows you the true motive at play here.

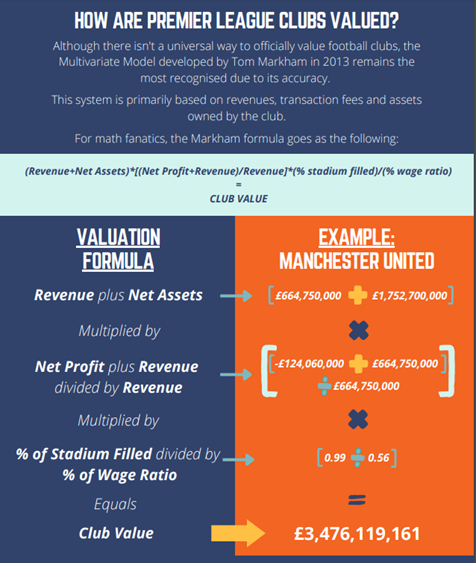

To give you some idea of what these clubs are worth, below is a handy chart that details the current list of 20 clubs participating in the 2022/23 EPL season.

Source – Sports quotes & facts

Six of the twenty are valued over a £1 billion. For those of you, like me, into the minutiae of how one comes to those figures, here’s the example for Manchester United.

Source – Sports quotes & facts

The precise formula is not relevant here. And it’s only an approximation. Just as United’s current owners who are holding out for over the value of the club based on the above formula.

It is expected the final sale price could exceed £5 billion. And that doesn’t include paying back £1 billion pounds of debt secured against the club.

An effective price of £6 billion is a lot of money for a football club that does not make large profits but has very cash-hungry employees (players).

So, if both prospective owners arguably aren’t fans of the club with rose-tinted glasses on, what’s the true motive?

What if you view these football clubs not for football, but their real estate?

It always comes down to the land.

As a piece of real estate, Old Trafford stadium is the biggest football stadium in the UK. It regularly sells out all 75,000 seats every home game. If you’re a real estate investor yourself, you’ll be amazed at the income those games produce.

However, one of the main reasons the Glazers want to sell is the stadium is now run down and significantly out of date compared to their domestic and European rivals. Its roof has numerous leaks, and its public toilets are prone to flooding!

It’s been reported a minimum €200m would be required to fix all this and add an additional 20,000 seats.

However, when you look closer at what some of United’s EPL rivals are doing with their own stadium renovations the potential becomes clearer.

Tottenham Hotspurs borrowed close to €1bn to redevelop their London based home to allow a 63,000-seater stadium to produce match day revenue of €125mn. However, Spurs stadium is purpose built to hold non-football events like American NFL games and concerts.

These increased commercial income by 21% last year.

But the ultimate example is cross-town bitter rivals, Manchester City. In 2003, the club moved to the City of Manchester Stadium, which had been built for the 2002 Commonwealth Games.

After being bought by the Abu Dhabi royal family in 2008, it was renamed “The Etihad” after the club’s main sponsor acquired stadium naming rights. Despite not owning the 53,500-seat venue, it has become the centrepiece of a regeneration project in east Manchester, including the club’s training ground and youth academy.

This Google Earth view shows you the extent of gentrification done on the surrounding areas around the main stadium (centre of the above image).

It cost billions to do this, with funding all coming direct from the UAE. But I ask you, what do you think this investment has done to the value of the surrounding area?

Heres a similar view of Manchester United’s surrounding area.

Quite a different picture, no? The club owns more than 40 acres of land around the site — a mix’ of car parking space, old warehouses, and sections of a freight terminal.

Considering the enthusiasm with which the city council showed Manchester City’s owners when presenting their plans for redevelopment, there would be little resistance to United’s new owners should they present plans for commercial, retail and hotel development.

How can I be so sure?

Andrew Western, Labour MP for Stretford, and Urmston — Old Trafford’s constituency — said any redevelopment of the stadium had “the potential to be a game-changer” for the surrounding area. Western, who until last autumn was leader of the local authority, added: “I know that Trafford council has huge aspirations for the area.”

So, should either bidder be successful, then there’s every reason to start investing in the infrastructure required both for the football club but also the surrounding area. And to do so, you need access to a lot of finance.

It’s here that we see the timing behind all this. As I’ve stated previously, we are currently rushing head long into the peak of the current 18.6-year Real Estate Cycle a few years away.

And I’ve also brought to your attention that there is currently an infrastructure boom happening across the world.

This is the ‘time’ in the cycle where these buyouts occur.

Consider this fact: at the same time last real estate cycle, the Glazer family borrowed 100% of what they needed to buy out then United shareholders and grabbed full control of the club.

They accessed ‘payment-in-kind” finance from US banks with an interest rate north of 17%! And secured it all on the club, or more precisely the assets, mainly land, owned by it.

And here we are yet again. The difference this time is, while easy credit will still be required by the new owners to finance the redevelopment, the Glazers did no such thing first time around.

The only way then to return true value in kind from this purchase is to create it via gentrification of the surrounds. Which will manifest straight into the land value.

This is why there are only certain times every cycle when such purchases can be attempted, and why the real estate cycle continues to turn like clockwork.

Once again, we dive deep behind the headlines and find the truth.

None of this has anything to do with football. This is a land play, pure and simple. Football is the means by which a landowner can extract value.

A footballs team’s fortunes can wax and wane on a competitive field of play, but the land market endures.

This is why it’s so important to your long-term future you understand it, and the vital role it plays in an 18.6-year Real Estate Cycle.

Here’s where you find such knowledge, via a membership to the Boom Bust Bulletin (BBB). Give me the opportunity to take you in depth into the cycle.

Learn about the over 200-year history of the 18.6-year Real Estate Cycle and why even today it continues to repeat like clockwork.

It will teach you how to decipher the news that we get bombarded with every day to focus solely on what truly matters.

No more negativity and noise, just the science of the economic rent and the timing inherent in the real estate cycle.

This is all you need to succeed.

Let me ask: why are you here? Why are you reading this newsletter today?

Are you seeking investment knowledge, or trying to understand why the world is the way it is? Are the continued rate rises over the last 12 months or so created serious headaches for your investment goals? And you’re seeking the right type of guidance to assist you?

Whatever it is, it’s personal to you alone. It’s my belief that you are interested in the real estate cycle, how it works and how one can benefit for yourself and your family.

To me, that’s why you’re reading today. If that’s true, then I’ve two words for you.

Start now.

This moment, right here, is the hardest part of any journey. The good news for you is you won’t be alone.

That’s how the BBB can help.

As a Boom Bust Bulletin member you will receive 12 monthly editions a year detailing all the key turning points of the cycle, a deep dive into the most important markets across the globe and ways that you can personally benefit from this knowledge.

All derived from our unique and proprietary research – which you’ll not find anywhere else.

Plus, you’ll receive exclusive invites to BBB member-only webinars when we run them.

All this for just US $4 a month, less than a takeaway coffee.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.