Why 18.6 years?

For over 25 years Phil Anderson has studied economics and markets. And he can say categorically that the Western economies exhibit an 18.6 year real estate cycle. Generally this averages out as 14 years up and 4 years down.

The Western economies exhibit an average 18.6 year real estate/credit cycle. Generally, this averages out as 14 years up and 4 years down.

A study of US history, for example, reveals a very clear (average) 18.6 cycle in US real estate prices, measured from trough to trough or peak to peak. The actual cycle has never been shorter than 17 years, never longer than 21. According to Phil’s research, the Australian, UK and other Western countries economies follow the US at the major market moves although in Australia each state ebbs and flows differently in between.

The good news is that once you understand the real estate cycle, you can forecast it. History, we assure you, does repeat. And if you can forecast correctly, you can make money, protect your capital, make informed business and investment decisions and leave a legacy for your family.

What does Phil mean by a real estate cycle? It’s how the economy will move — and why — over time. You’ll have a guide as to when to buy real estate and when to stay out of the market. You see, it’s the land values and corresponding credit that leads the economy. You’ll understand much more about the stock market too. It is important to understand both to make the best investment decisions.

Phil’s book The Secret Life of Real Estate and Banking outlines that the cyclical economic behaviour will repeat. Once you discover the fundamental law of economics — 19th Century economist David Ricardo’s Theory of Rent — you’ll see that a repeat is all but inevitable. Why? Because the underlying structure of the economy never changes, despite the endless fiddling and additions in regulations and laws.

Check out the chart below. It shows the volume of land sales in the US each year. Starting, of course, from 1800.

The roughly 18-year timing of the boom bust is uncanny.

And note, with every peak in US real estate, a bust soon followed. And this cycle has simply continued into the 21st century.

Have a look at prior real estate peaks back in ’73, ’89 and the big run up into 2007. You know what happened after that, right?

Each 18.6-year cycle consists of an average 14 years up. Then four years down.

Each 14-years up can further be broken into two parts. Around seven years each, split by a mid- cycle slowdown or recession.

The final two years of the 14 years up we call the “Winner’s Curse” period. By then asset prices are overvalued and being highly leveraged. This is not the time to be all in and highly leveraged.

This occurs in nearly all western countries. Whilst the US is still the largest economy in the world, other countries follow.

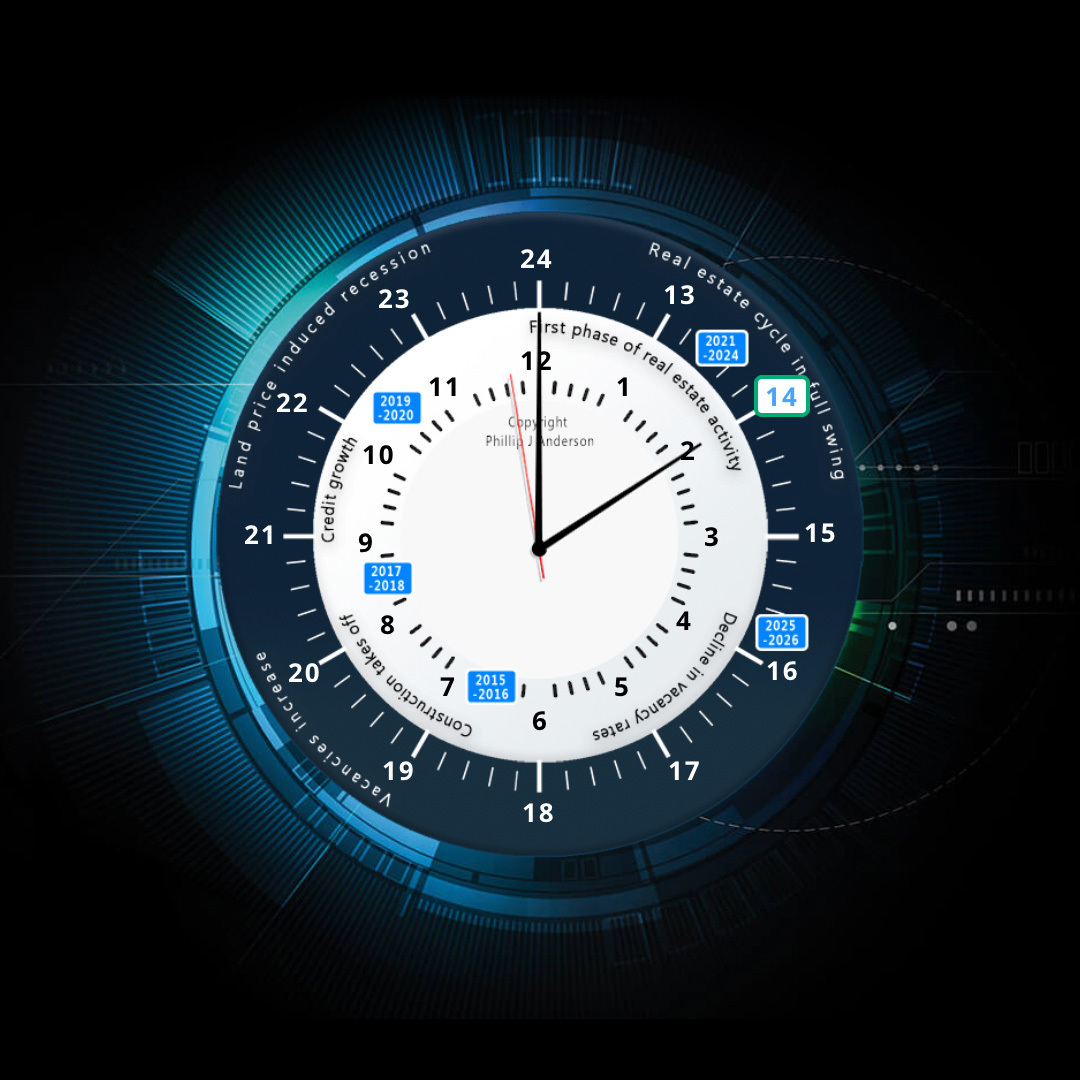

The Real Estate Clock

And the clock, as shown below, shows that sequence.

The inner circle, from one to twelve, tells us what happens during the first nine years of the cycle. This is the recovery and growth phase.

While the outer circle from thirteen to twenty-four is the second nine years. That’s where speculation is at a frenzy. That’s the boom phase before the bust.

This is your working template for how the economy does actually move.

Get ready for the biggest boom

The Covid-19 pandemic has been an extreme emotional event. Governments worldwide have all but thrown the kitchen sink at it.

But keep in mind, this is not unprecedented. It’s reminiscent of 100 years ago from 1919 – 1921. When 50 million people died from the Spanish Flu.

And what happened after that?

The biggest bull market of all time. You’d know it as ‘The Roaring Twenties’.

Keep sight of the bigger picture. Know the cycle and know your history. We are only at the middle point of the current 18.6 year cycle.

Since 1955, the mid cycle pauses that split the 14 years up were quite regular: 1962, 1981, 2001/02 and now, 2020 and into 2021.

Yes, 2020 and parts of 2021 will be recessionary and involve a bear market. And for some it will be a painful time.

But should history repeat, markets are likely to recover strongly.

USE THIS WINDOW OF OPPORTUNITY NOW

It’s in the second half of the cycle where the biggest gains are made. That still lies in front of you.

The real estate cycle is now a global one. And that means the current boom is likely to be even bigger than the one before.

And not to mention emerging markets – where there is so much more room to grow.

There is a window of opportunity opening up right now – to profit from current events.

To ensure you are making the right investment moves at the right time and not be blindsided by so called ‘black swan’ events, click here to get started.

I have learned a lot from Phil’s presentations, emails and the website. He has always been very generous in sharing the knowledge and insights acquired from his research, explaining the many influences on market movements and the fact that these movements can sometimes be forecast well in advance. Best of all he is very approachable and easy to understand. Keep up the good work Phil!

Connie, Melbourne, December 2011.

I have learned a lot from Phil’s presentations, emails and the website. He has always been very generous in sharing the knowledge and insights acquired from his research, explaining the many influences on market movements and the fact that these movements can sometimes be forecast well in advance. Best of all he is very approachable and easy to understand. Keep up the good work Phil!

Connie, Melbourne, December 2011.