If you would like to receive weekly updates like this, sign up here.

“I decided to take two weeks in quarantine now, rather than wait for the third lockdown to come in September,” she said. “It was a bit of a risk waiting until the end of October to come up to Darwin.”

“I didn’t feel mentally that I was going to get through another six weeks in lockdown.”

The above was a quote from a blog I wrote way back in October 2020.

Normally not that long ago, but with all of us suffering through various lockdowns it certainly feels like that.

If you’d like to read that blog for the first time, or refamiliarize yourself, click here.

Now is a good time to revisit what I wrote in it.

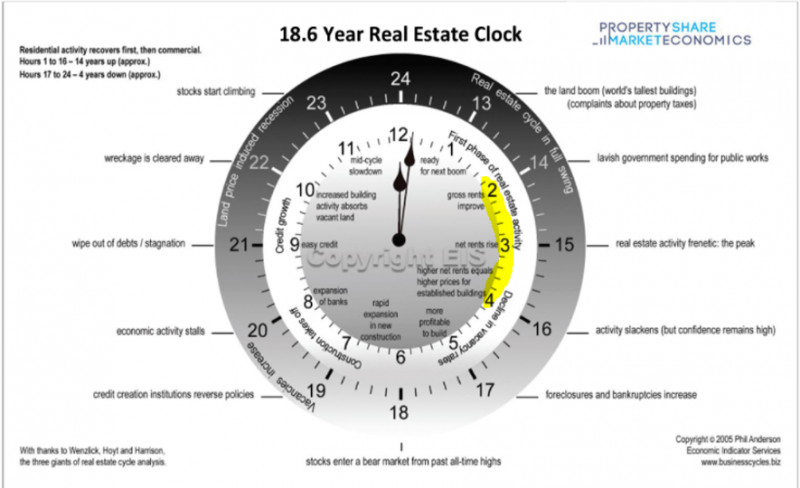

At the time, I labeled what was occurring in Darwin (and you can include Perth here too) as indicative of how the Property Sharemarket Economics (PSE) property clock turns.

Have you kept up with what has occurred since that time?

Frankly, I cannot think of a better way to show you in real time how this property clock works.

And show you how you can take full advantage of such knowledge.

Read on.

Property clock says….

Back in October I looked at how the Northern Territories more relaxed and straightforward guidelines for undertaking quarantine prior to residing there was driving a lot of interstate movement from those southern states most affected.

I said that the evidence was mounting that Darwin’s own property cycle was turning with these migrations.

The best way is to show you via our own property clock below.

Source: Property Sharemarket Economics

Source: Property Sharemarket Economics

Please note the highlights in yellow. This is the part of the clock we will focus on today.

From that October blog below.

“The economy runs in identifiable cycles; we show this like a 24-hour clock. While an economy is not as precise as a watch, the 24-hour property clock acts as a useful guide.

Right now, Darwin is slowly emerging from years of below average growth both economically and population wise. Its population is also transient as Defence and Government personnel get posted into and out of the city. It is also very closely tied with the commodity cycle.

As a test case though it’s ideally placed as a Capital city about to start its path along the property clock.”

This was the premise back when I first wrote about it.

This far into the overall 18.6-year Real Estate Cycle in Australia, it’s hard to find a capital city so near to the beginning of the property clock.

Cities like Melbourne, Sydney and Brisbane are slowly moving into the second phase of their clocks starting at 13 o’clock.

I know you already know it but far out, this stuff is magnificent. I’m so pleased to be receiving your emails and education. I’m not sure how to share my joy with you other than to simply get in touch and thank you again!!! You are most certainly a beacon of wisdom and truth. I’m excited to delve into the concept of time via Gann.

My deepest appreciation and best regards.

Eric

Here was the story on the ground back in late 2020. And the reasons behind why I nominated Darwin’s position on the property clock.

“Per SQM research, week ending 20th September 2020 the 12-month rate of change for house rents in Darwin has seen an increase of 3.7%.

The last quarter saw house rents rise by 10.5% and a vacancy rate recorded in August of 1.1%. Property listings have also been falling since March this year too.

This strongly suggests a trend of rents being bid up in order to secure the best properties as less are being listed for rent.

According to the property clock then, Darwin would be between 2 o’clock and 3 o’clock. So, between Gross rents and Net rents rising.

Now that is established, we can then watch for signs that the clock has progressed to 4 o’clock.”

So firstly, is this still the case?

Did my protestations hold water since October last year?

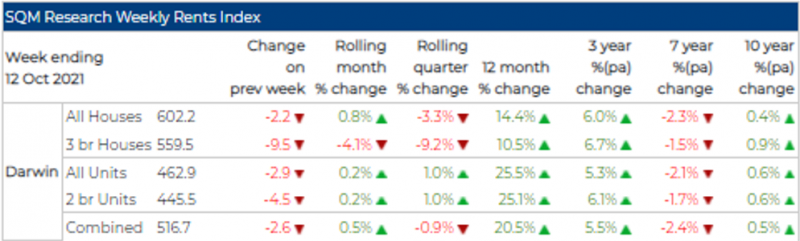

Source: SQM Research

Source: SQM Research

Firstly rents. House rents recorded a 10% increase up to August 2020. As we have now passed more than 12 months since then have rents continued to rise?

Per the SQM chart above, units saw a 25% rent increase over the last 12 months and houses saw a minimum 10% rent rise for detached houses.

So, rents have continued to rise.

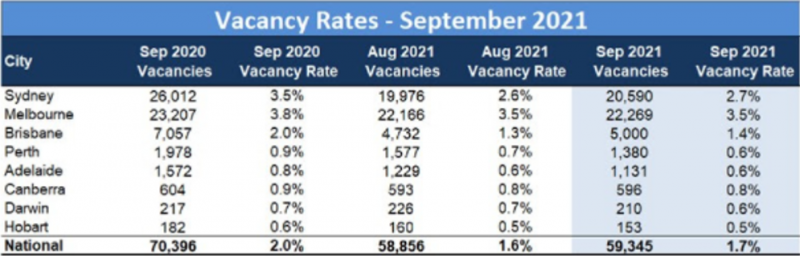

What about the vacancy rate? It was stated at 1.1% in August 2020, which is saying there’s almost nowhere to rent.

And now?

Source: SQM Research

Source: SQM Research

Its now worse than that; September 2021 vacancy rate was recorded at 0.6%.

There is now nowhere to rent.

I would say with confidence then the call in that October 2020 blog that Darwin was moving between 2 and 3’clock has been validated.

Now we need to determine whether the clock has turned again and moved to the 4 o’clock position on our property clock.

That position on the clock relates to the following. Higher net rents equal higher prices for established buildings.

In other words, the gains (increasing rents) will over time begin to be captured by the land. This then equates to the land price continuing to rise.

What has the Darwin land market done then since August 2020?

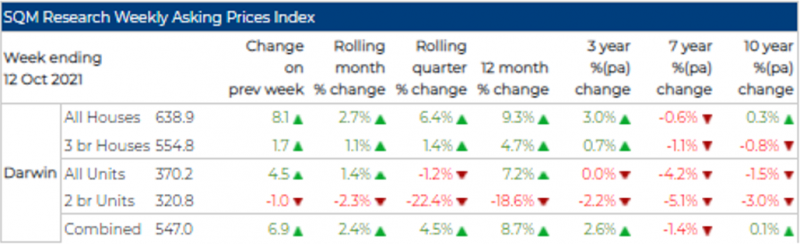

Source: SQM Research

Source: SQM Research

With one significant outlier, house and unit prices have seen 12 months increase between 7 to 9%.

The rent increases and virtually nowhere to let has seen demand driving towards buying instead.

So, it seems available stock is now being bid upon and brought.

However, owners of 2-bedroom units aren’t enjoying similar gains. Why would that be?

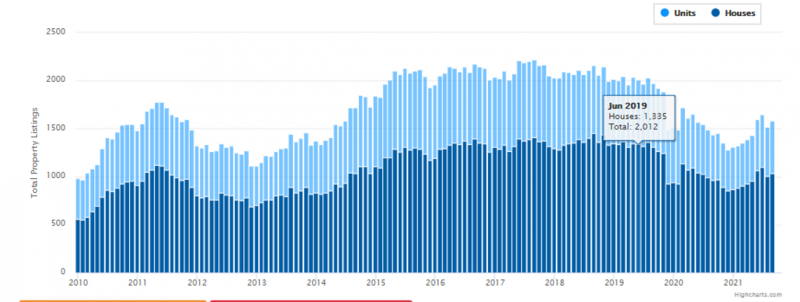

Source: Highcharts

Source: Highcharts

Above is a chart of the available supply of homes and units in Darwin.

Dark blue bars represent houses and the light blue bars for units.

There is far more supply of units relative to houses. All of them are rented out but its hard for these owners to sell them given the competition.

Houses however haven’t seen this low level of supply since 2014.

The weekly asking price index bears this out.

Overall, it’s clear that the higher rents are now being captured by the land and leading to higher prices for established stock.

We can now move onto the next stages, 5 to 6 o’clock.

From the property clock, this is more profitable to build and rapid expansion in new construction.

And we can now watch this together to see how it unfolds.

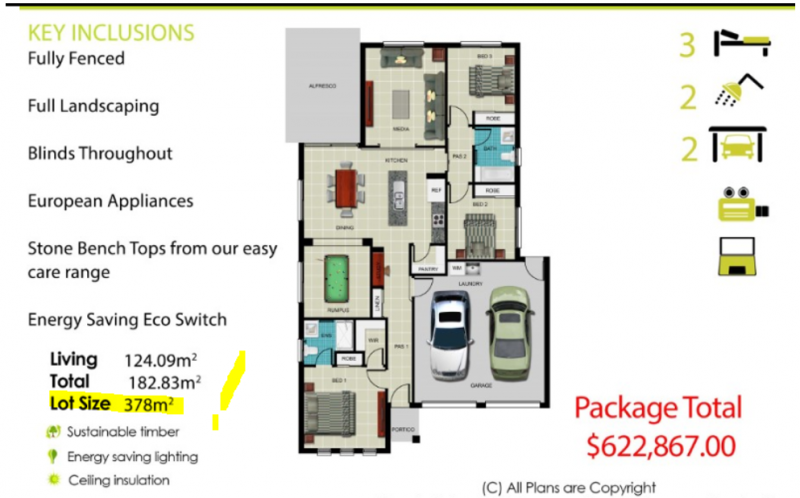

Mind you, one must ask exactly “who” it’s more profitable to build for. Here is an image from the Abode homes website in the Northern Territory.

Source: Abode homes

Source: Abode homes

I have highlighted the lot size. These are the type of homes where you can open your bathroom window and touch the house next to you.

And with no space to install a pool or a backyard deck the opportunities to increase the value and desirability of your home relevant to all the other identikit homes in your street are limited.

Profitable for the developer; yes. The homeowner, less so.

We can also see building begin to expand out. In Darwin, the two most desirable places to reside are the CBD itself and the Northern suburbs. Both these areas are close to being, if not already, built out.

Hence new buyers need to move further away from these locations (and their work) to find new homes to buy.

Source: Abode homes

Source: Abode homes

North crest is reclaimed industrial and farmland in Berrimah. Right next to the flight path to Darwin International airport.

Berrimah farm was found to have elevated levels of contamination in its soil but don’t let that put you off apparently!

Newer suburbs like Zuccoli along with newly redeveloped existing suburbs like Humpty Doo and Durack are the only areas now available to be developed within a decent travel distance to the CBD.

You could watch and see how things develop.

Or you can use this knowledge to accelerate your own property portfolio and become a member of the Boom Bust Bulletin (BBB).

Learn the history of the 18.6-year Real Estate Cycle, why it repeats repeatedly and how to best take advantage of the opportunities it presents.

So, what would Rosie Zarro think if she became a BBB member back then? She is the woman for who the first quote at the start of this blog is attributed to.

What if Rosie was aware of the PSE property clock back in October 2020?

She would know how the forecast for ever rising rents would affect the prices for homes moving forward.

She could have brought with the knowledge her purchase would have an additional 10% equity thanks to these rising rents being absorbed by the land.

And avoid the stress of trying to bid for a rental when there is no supply.

All for $4USD a month. Incredible value.

Best regards,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.