If you would like to receive weekly updates like this, sign up here.

Sometimes it’s worth looking back at the past, even if you already know the outcome.

I don’t watch a lot of TV nowadays.

Thanks to streaming services like Netflix, I can pick and choose precisely what it is I want to watch, when I need (or can) watch.

I’m a big sports fan, and so I’ve made it a yearly ritual now to go back and watch Netflix’s series “The Last Dance” about a team I watched when I grew up – The Chicago Bulls.

Or more specifically, Michael Jordan, and the story behind his last record breaking NBA title in 1998.

Now since I was a big Bulls fan and I followed them closely during their heyday, I already know what’s going to happen – but I still learn a lot from reengaging with their journey.

For me, the real estate cycle is the same.

I was reminded of this truth yet again after reading the recent headline below.

Source: Washington Post

Source: Washington Post

Now, for those who are in the thick of this fighting other tenants to try and find suitable accommodation for themselves and their family the following will prove cold comfort.

But you could have known this would happen.

And plan accordingly.

It’s time to take a closer look.

Those who can least afford it, will end up paying the most.

The United States remains the world’s largest economy.

It has the world’s only reserve currency, the biggest and most liquid stock and bond markets and the largest military in history to defend it all.

It’s an incredibly potent mix.

But it also holds another very important distinction.

It leads the world into and out of every 18.6-year Real Estate Cycle since records began over 200 years ago.

And that’s our focus today. Where is the US in its own real estate cycle? Can it explain the current explosion of rents across the country?

The Washington Post article above attempts to address this. From the article.

Rents continue to rise at the fastest pace in decades, making housing costlier than ever for many Americans.

Nationally, rents rose a record 11.3 percent last year, according to real estate research firm CoStar Group. That fast pace of growth remained elevated in the first months of 2022, as many parts of the country continued to notch double-digit jumps in rent prices.

“A supply-demand mismatch is making rents unaffordable,” said Dennis Shea, executive director of the J. Ronald Terwilliger Center for Housing Policy at the Bipartisan Policy Center. “The lowest-income families are being hardest hit by rising rents and a lack of supply.”

I refer you to the header for this paragraph.

It neatly sums up the increasing divide between the haves and have-nots.

And why our co-founder of Property Sharemarket Economics (PSE) Phillip J Anderson has always said to members and anyone else who will listen.

You need to own some land for yourself. Better still find someone else to pay it off for you.

But I digress.

Now, before I explain how you could have had advance warning of this dilemma, we need to address the obvious first.

You see, the history of the real estate cycle shows us that each 18.6-year cycle is different to the one preceding it.

Events play out quite differently each cycle even if the underlying drivers of the land market and economy never change. Here’s two examples.

No-one could have foreseen the Covid related outbreak and lockdowns across the globe and the repercussions that followed. Its only now that these are starting to manifest.

One was the spike in inflation directly tied to the damage these lockdowns caused to the global supply chains.

This has resulted in real and tangible issues when it comes to real estate. Despite some of the best fundamentals for land and property developers on the ground in the US ever it’s very difficult to build a home with no materials!

Then there’s the fact that across the US owner-occupiers have enjoyed stellar gains. Unless they receive the mother of all offers, these owners are more than content to sit tight and allow their property to continue to rise.

So limited supply of existing homes added to a huge supply disruption to newly built ones.

Next is the effect the lockdown had on normal working lives and the desire to escape the worst lockdown conditions in capital cities by looking to buy or rent in more regional areas.

Technology allowed most office workers to continue to work as normal via software like Zoom. Plus, the time saved by not needing to drive to and from the office.

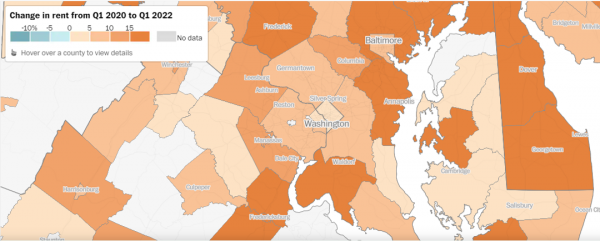

Its summed up nicely via this heat map.

Source: Washington Post

Source: Washington Post

Note Washington D.C in the centre there. Its population is just under 700K. See the fact the surrounding suburbs like Waldorf and Annapolis are a deeper colored orange.

It indicates a sharp increase in average rents compared to D.C.

Charles County in Waldorf has seen a 17% increase in average rents between Q1 2020 to Q1 2022.

Or Anne Arundel County in Annapolis with a 15.6% increase during the same time period.

So, how IS it possible to know this in advance. I agree the Covid outbreak and fallout was completely unexpected, and no-one could have forecast it.

But the rent increases, the high home prices and moving further out into regional suburbs?

Let me show you.

Make this knowledge your priceless advantage!

Unless you follow these things as a matter of course, it may be hard to realize the same dynamic is being played out just about everywhere.

I encourage you to read this recent blog on how this so-called migration to regional areas is beginning to unravel quickly here in Australia.

The fact is the PSE teams’ study of the lessons of over 200 years of real estate history in the US and elsewhere tells us that this behavior isn’t unique at all.

It has happened in every real estate cycle before. Not only that, but it occurs at the same time of each nation’s own unique real estate cycle.

Incredible! And yet true; you can be prepared for this time well in advance.

Our proprietary clock and knowledge of the cycle meant we advised our members that, contrary to what the media suggested, the Covid lockdown period was one of the best remaining buying opportunities this decade for people who wanted to buy a home.

Why was that? Take a look.

Source: Property Sharemarket Economics

Source: Property Sharemarket Economics

Here is our PSE property clock. It’s currently pointing at 13 o’clock. Midday (12 o’clock) was what we call the mid-cycle recession. Ironically, this was when the Covid outbreak and lockdowns began.

Using your mouse to highlight 13 o’clock on our website unlocks the following text – The land boom and world’s tallest buildings.

And here we are! Buyers during the mid-cycle recession are sitting pretty now, and avoiding the awful pressure faced by millions of Americans who are battling ever increasing rents.

So, what happens next? You can find out by becoming our newest Boom Bust Bulletin member.

It will teach you the history of the 18.6-year Real Estate Cycle, why it continues to repeat to this day and help guide you towards the opportunities it presents as the cycle turns.

Perhaps you are one of these renters who are experiencing the pressure of low supply and high rent prices.

You may be thinking it’s impossible for me to get that leg onto the property ladder.

Well, there are other ways to make sure you DO benefit as this current cycle reaches its peak.

Find out what exactly they are.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.