If you would like to receive weekly updates like this, sign up here.

We stand looking out over the precipice.

Before us is the financial world as it’s been for more than half a decade.

Yet the winds of change are beginning to blow, slowly at first but with increasing frequency.

The media are starting to cotton on to what’s about to occur.

Source: Bloomberg

Source: Bloomberg

Source: AFR

Source: AFR

The storm that is brewing is this; will the US lead the world into a massive round of interest rate hikes to head off inflation?

Critical to this debate is the role of the traditional banking system.

My question to you is this. Do you know how money is “actually” created? And secondly, do you understand how important the land market is to the wider economy?

It is the answer to these which will give you the clearest possible view of what’s about to happen for the rest of this decade.

So important these answers are to your long-term financial wealth that I’ve decided to share this exclusive look at the recent Boom Bust Bulletin (BBB) edition.

Titled; “The true secret to money creation revealed”.

This edition was guest-edited by Property Sharemarket Economics (PSE) director and co-founder Akhil Patel.

I cannot think of a more credentialed writer on this subject.

Akhil laid some well-trodden myths about money creation and the banking system to rest for our valued BBB members.

I trust you’ll enjoy this sneak peak of what Akhil said to them.

———————-

The Secret Life of Banks

I have often said that there are two things you need to properly understand to see what is going on in the economy.

The first is to understand land. Why land is fundamental to the economy and why, in our current system, it ends up becoming the ultimate speculative asset.

And why, therefore, we must get real estate cycles. Darren has explained this to you in prior editions.

If you understand the land side of things you can always forecast what will come next for the economy.

The second thing is to understand how money and banks work. This will tell you why cycles get so big, especially in the second half (which is where we are now) and why, when they turn down, things get bad.

It is this second point I will cover in this edition. And once you understand this, you’ll understand our system in a way that is beyond 99 per cent of most economic and financial experts.

So, to begin, let’s address a couple of myths about what banks do.

Myth 1: Banks take your savings and lend them to borrowers

Here is the first myth. From the website of Federal Reserve Bank of San Francisco (a branch of the US central banking system):

How banks work

Banks operate by borrowing funds – usually by accepting deposits or by borrowing in the money markets…They then used these deposits and borrowed funds (liabilities of the bank) to make loans or to purchase securities (assets of the bank).

This is the simplest version of the myth.

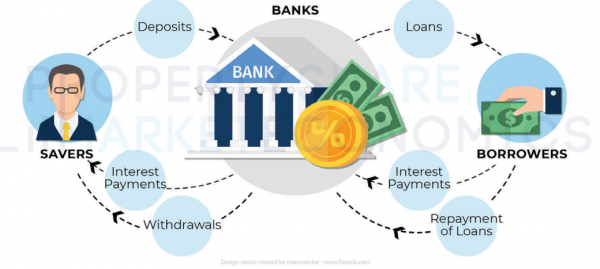

Banks act as intermediaries between those who have surplus money and those who have a deficit. Banks address this problem by channeling money from one group to the other.

To compensate the saver the borrower must pay interest, again channeled via the bank.

This is depicted in the diagram below.

Figure 1. The bank as intermediary.

I will not dwell on this any further. This idea of banking is so basic and wrong that not even economists are taught it at university.

But you will occasionally see it used as a simple way of explaining the function of a bank.

In textbooks, economists will be taught a second myth which, while more sophisticated, is also wrong.

Myth 2: Banks multiply money deposited by savers

In this version of the myth, banks are a bit cleverer than the neutral intermediary depicted above.

They worked out that at any given moment only a small proportion of savers will require access to their money.

So, banks decided to keep a proportion of this in reserve and earn more in interest by lending out a multiple of the money deposited with them.

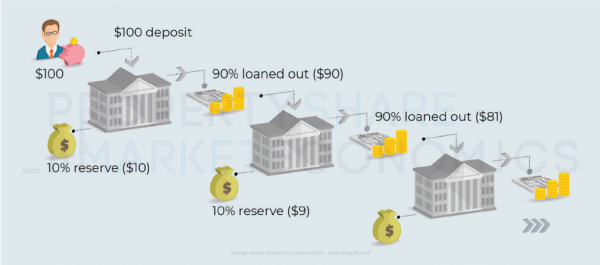

It looks a bit like this.

The $100 deposit in one bank leads to $90 in loans. If this $90 is then lent out again once deposited, the bank will hold $9 in reserve and lend out $81.

The two loans so far total $171 ($90 + $81) – more than the original deposit.

See the diagram below.

Figure 2. Banks multiply money

This process can go on until all the money has been loaned out. By setting aside 10% of an original $100 deposit, banks can between them support $1000 in borrowing.

This is sometimes known as “fractional reserve” banking, named after the fraction, that needs to be held in reserve to meet people’s need for money at any given point.

The final part of this picture is the role of the Central Banks. They enforce the reserve requirement to stop banks overdoing their lending (because lending is lucrative and so they will want to minimize the reserve to maximize their profits).

Central banks are also responsible for ensuring that the financial system has enough liquidity to meet the needs of depositors – including, by stepping in to lend funds to banks that have a (temporary) shortage of liquidity.

In this version of the myth, banks are money creators/multipliers.

It’s a powerful myth. For example, here is a quote from someone who is now considered to be important to modern discussions of banking and money:

“The problem with conventional currency is all the trust that’s required to make it work….Banks must be trusted to hold our money, but they lend it out… with barely a fraction in reserve.”

These famous words were written in a thread on the P2P Foundation website, on 11 February 2009 by someone going by the name of Satoshi Nakamoto, the so-called founder of Bitcoin.

But his articulation of the problem that Bitcoin is intended to solve is also incorrect. Banks are not money multipliers in this way.

The problem with both myths is that it assumes that money exists independent of banks.

The original customer has money and wants to save it somewhere safe: the bank. Only once such money is deposited the bank can start lending.

This is not true. Most money exists, by and large, because of bank lending activities.

In other words, banks create the money when they lend. It is this money that people use to exchange goods and services. And then those who want to save their money do so in a bank account.

Loans create deposits and not the other way around.

Pretty much all money that is used in the modern economy originated first with banks advancing loans.

———————-

As you can see, Akhil has laid out very succinctly as possible to you the myths that everyone has always been told about how banks ‘create’ money.

In this BBB edition, Akhil went on to explain the process on the banks’ balance sheet and why the money printing of central banks is the cause of inflation is in fact a fallacy.

He also went in depth about gold or Bitcoin backed money ideas being touted today and why these simply cannot work.

And why debt levels and the land market are intrinsically linked.

This was truly one of the most important issues of the BBB we have yet released.

If you wish to be ahead of the curve when it comes to the prospects for inflation and how these will affect your future investment decisions, then the choice here is clear.

Become our newest member of the Boom Bust Bulletin.

It will teach you the history of the 18.6-year Real Estate Cycle, why it continues to repeat to this day and provide you the guidance and research that can really make a difference.

The banks are currently laying the groundwork for the biggest boom in history.

And yet it is the banks and the land market that will call in the top and eventual bust.

Do not be on the wrong side of such a turn.

Let the BBB show you how you can work this out for yourself.

All for just $4USD a month!

Incredible value.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.