If you would like to receive weekly updates like this, sign up here.

If there’s one word I can use to sum up stock markets around the world at the moment it is this: volatile!

Sometimes it’s hard to believe the way the markets can move.

Not just billions of dollars of wealth vanishing, but the emotions they elicit.

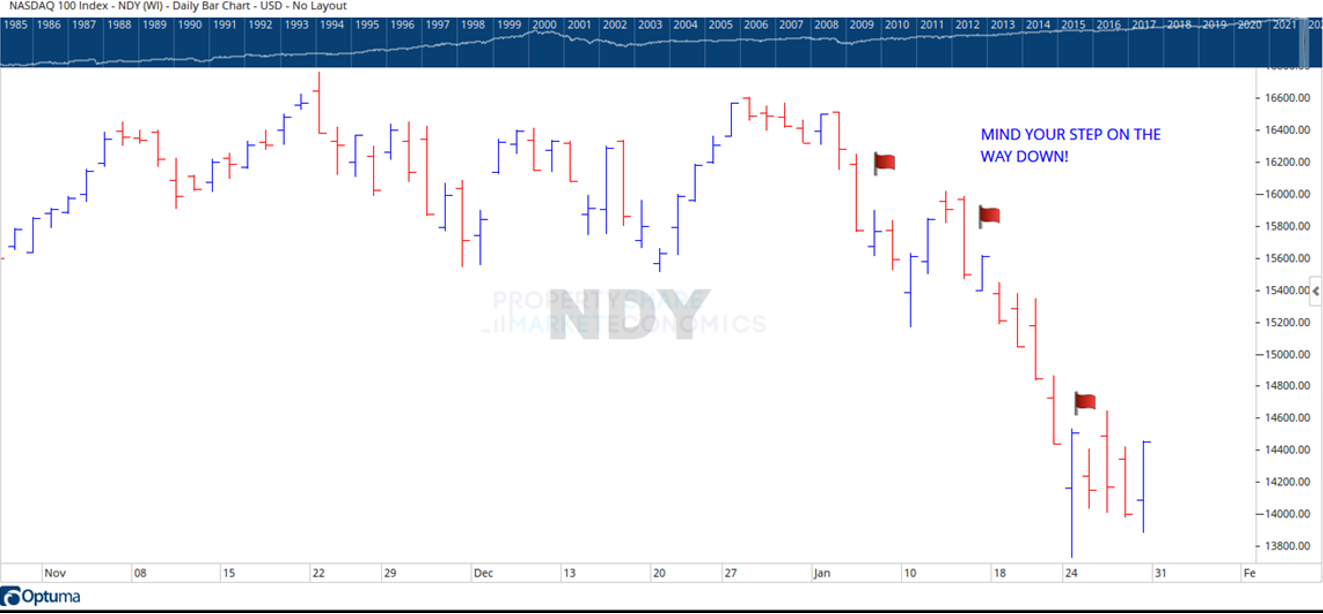

Here is a chart of the NASDAQ for 2022. Were you surprised by the speed and violence of this fall?

Which is of absolutely no help whatsoever if you happen to be in the market now and struggling to comprehend what’s happening and what you need to do.

Are you able to see just how helpful it would be, in times like these, to have an overarching guide to show you what to do, and when to do it?

Our research of the 18.6-year Real Estate Cycle and its effects on world stock markets highlighted just how volatile 2022 would be.

“Forewarned is forearmed”, as the saying goes, and it’s for this reason that Property Sharemarket Economics (PSE) produces an annual stock market road map.

Recently PSE Co-founder and Director Cathryn Stacey produced a deep dive across all our forecasted stock market work. This included a close look at our 2021 roadmap.

This is simply an incredible document, unrivalled anywhere else in the financial world.

And it is exclusive for our valued PSE members.

By the time you read this, our 2022 stock market roadmap will have been released.

If you really want to maximize the opportunities the real estate cycle will present this year, then this is the one document you can’t be without.

In fact, so convinced I am about this that I have decided to share some of the forecasts made in 2021.

These were collated across all our related emailed alerts to members and became our “2021 year in review” report, released in December 2021.

This should give you an idea behind what we research and how we communicate these. To be fair to our current members, the hyperlinks present in the original report have been removed.

So here is the breakdown of the 2021 stock market roadmap forecast from our year in review report.

————————————————————————————————

PSE Member Update #53. December 29, 2021

By Cathryn Stacey.

As we wind down 2021, we’ve taken the opportunity to review what has been an interesting and unusual year. But not unexpected. History shows that years ending in 1 tend to be volatile and/or recessionary from an economic perspective with much disruption.

However, they set the stage for much of the rest of the decade. 2021 was no different. It seems appropriate then to look back at some of the Property Share market Economics (PSE) exclusive member updates.

This will be a succinct summary of how we’ve fared with our forecasts, our read of happenings globally and suggested market movements.

The 2021 Road Map did conclude with this:

We’ve found the preparation of 2021 a little harder to do this year.

Starting off at all-time new highs for 2021, whilst certainly not a first, is not the most common pattern. Though with monetary conditions the easiest they’ve ever been history, should we be all that surprised.

The market in 1991 began close to new highs. So too in 1971. Notably, the 1961 Dow (60 years ago) broke into all-time new highs during that year.

So, the 60-year patterns continue to be helpful to us.

The 2021 Road Map was a large body of work that was released to PSE Members on the 4th of January and 7th January. It also included:

- The Seasonal dates

- The 10-year DJI Forecast

Phil and Akhil are currently preparing the 2022 Roadmap which will be published in January. They will do an analysis of the 2021 forecast in this report.

If you noted the 22 February #GANN email update Phil reiterates the Road Map with an early May top for the US Dow Jones Index.

Here’s what he said:

If the Dow is higher at this time, perhaps March 21 may mark mid-way, pricewise, between 29 Jan and a possible early May top.

Indeed, the March 21 range did mark a top. We calculated a suggested top of 35156 in the April 6 email update.

In the end the market made a top on 10 May just 60 odd points shy of the forecast at 35019.

What the different indexes did after that will be analyzed in the 2022 Road Map.

Still on February, I note Phil talking about Hertz, Tesla, and the Vatican in this email update. The focus was around what not to do when investing.

Like short Tesla.

Mentioning Tesla and Hertz back in February, does Phil have some kind of telepathic ability?

You may have heard about the Hertz/Tesla deal announced in late October?

Just a small order of say 100,000 electric vehicles (EV). Here’s Hertz’s weekly chart below. I have shown via the blue arrow when the announcement was made:

And Tesla’s weekly chart is found below.

It was reported that the order would take Tesla to a trillion-dollar company.

Note the stock building up into October and November and after the announcement the trend changed.

These are the days, it seems, where markets provide more drama than Hollywood.

As on November 2, Elon Musk tweets that ‘no contract had been signed with Hertz’. Here’s Hertz stock after that.

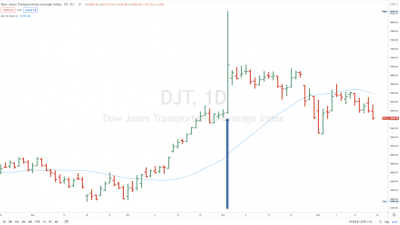

And look at what the news did to the Dow Jones Transportation Index (DJT) below. Akhil refers to the DJT a number of times in his updates.

————————————————————————————————

I write to you each week highlighting stories and trends that evolve as the real estate cycle turns and offer you a chance to learn what exactly the real estate cycle is via a Boom Bust Bulletin membership.

However, at certain times like now, when the markets have reacted like they have, I will make an extra effort to reach out.

Right now, the financial media is all caught up with the rise of inflation, the effect this will have on short and long dated bonds, and whether markets are poised to crash.

And instead of reliable and critical thinking on these subjects, it’s all emotion fueled rhetoric.

Just go and watch tonight’s news or scroll through websites like ‘Bloomberg,’ ‘The Australian Financial Review’ or ‘The Times’ to see what I mean.

Now contrast that with the type of targeted and timely research we provided our PSE members throughout 2021 and are poised to do in 2022.

I ask you to give serious thought to what Phil and Akhil provided our members using the roadmap as our primary forecast tool for markets.

Just how much is this level of guidance and research be worth to you as you navigate 2022?

Already many of our members are achieving incredible life changing gains thanks to our guidance.

Here is how PSE Member Jason felt about Phil’s August 2021 GANN email updates:

“Awesome update Phil! More like this, please! It feels great for the mind and soul. Thank you.” – Jason

So that’s your sneak peak at the 2021 stock market road map and some of the calls made by the team during the year.

The 2022 roadmap has now been published and has been sent out to all PSE members.

The markets this year are forecast to be very volatile (see the NASDAQ chart above for confirmation of that!).

It’s clear now that this roadmap is precisely what you’ll need to help you plan and navigate well in advance the movements volatile markets make throughout the year.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.