Some startling news I came across sheds light on precisely why we continue to have an 18.6-year Real Estate Cycle.

And why it continues to happen, on time, to this very day.

It’s been proved by a combination of three very different things.

So, you need to know this.

This newsletter will explain what’s happening, what governments and corporations are arguing about (this time!), and who the history of the cycle suggests will ultimately win here.

And, of course, how it affects any of your investments exposed to Artificial Intelligence (AI). Which means pretty much all your investments, because almost every listed company is turning to AI to drive future growth.

So, you don’t want to miss this edition.

What lengths would you go to keep the lights on?

From the off, I will say this. What I explain to you today is why you must learn to view the world through the lens of the real estate cycle.

You will see and understand things that are beyond most people because they don’t study the land markets.

So, it’s my fervent hope that after today, you won’t look at the humble data center the same again.

Look at the following headline.

Source – Financial Times.

Source – Financial Times.

From the above article.

Governments around the world are intensifying scrutiny on the building of data centres over fears that their huge energy usage is putting excessive pressure on national climate targets and electricity grids.

Ireland, Germany, Singapore, and China as well as a US county and Amsterdam in the Netherlands have introduced restrictions on new data centres in recent years to comply with more stringent environmental requirements.

According to this article, some of the most economically important countries in the world are curbing the expansion and building of new data centers.

Now, the reasons given are climate and energy related. Fair enough. But there’s more to this than meets the eye.

Let me ask you; what’s been the undoubted winning sector to have exposed your capital over the last few years? It’s been AI, has it not?

So, thinking logically here, the reasons why is that analysts expect ever higher earnings in the future as AI becomes totally mainstream. To meet such future demand, what does the world need more of?

Data centers.

Do you think for one minute the need and use-case for data centers is going to increase, or decrease, into the future?

If you think it’s the former, here’s some news out of Ireland that should interest you. From the above article.

A decision by the country’s energy and water regulator in 2021 to limit new data connections to the electricity grid is now having a “material impact at the ground level”, said Hiral Patel, head of sustainable and thematic research at Barclays and lead author of a report on data centres.

Data centre operators Vantage, EdgeConneX, and Equinix had permits for new projects in Dublin rejected by local authorities last year. Ireland’s data centres are set to account for 32 per cent of national electricity demand in 2026, the International Energy Agency forecast last month.

All developed nations have electricity grids that are widespread, well established…and old. They were critical enablers that drove economic growth in the 20th century. Clearly, though, they are not fit for purpose to deliver growth in the 21st century.

If we are to have a tech and AI powered future, it requires more data power. Predicated though on overcoming government hurdles based upon the reality their electricity grids cannot handle the load.

Folks, something must give.

And, thanks to my real estate lens, I know what it will be.

The headwinds this unstoppable trend must overcome.

The key to all this is one word used in the article. ‘permit’. Here’s the correct term for it. A government granted license.

And what governments give, they can damn well take away too. However, it depends on who we are talking about.

It’s one thing to be taking permits away from the Vantages and EdgeConneX’s of this world. But would they dare do it to Google, Amazon, and Microsoft?

That’s highly unlikely. Consider the UK government’s desire to “remaining and expanding as a global tech hub, and to the adoption of emerging technologies and AI”. You are nowhere as a global data hub without those three companies involved.

So, we can arguably rule out the very biggest companies in this space from being forced out of business by denying permits to connect to the grid.

But we still face the original problem here. The inability of current electricity grids to handle the growth. It’s time to get to grips on what’s at stake here.

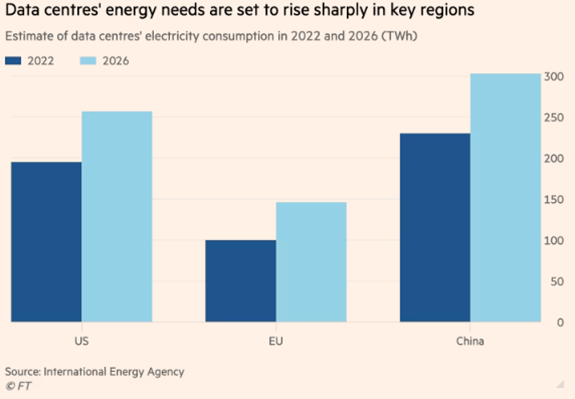

Source – Financial Times

Above is a chart from the International Energy Agency (IEA). The IEA stated last month that, globally, electricity consumption from data centres, cryptocurrencies, and artificial intelligence could double between 2022 and 2026.

Morgan Stanley analysts expect generative AI to drive more than three-quarters of global data centre power demands in 2027, based on 2022 numbers.

This could put pressure on the $220bn business of data centre and cloud companies, expected to rise to $418bn by the end of the decade as global data demands surge, according to market research group Industry ARC.

Finally, market research group Dell’Oro estimates global capital expenditure on data centres to exceed $500bn in 2027.

We are talking about some serious money here. But it also indirectly explains the insane valuations almost all listed AI companies have attracted over the last 12 months.

So, it’s a head on fight here between certain big tech corporations and governments.

Who does the history of the real estate cycle suggest will win?

Here’s an opportunity for you.

Here is why understanding the land markets is key. Data centers aren’t located just anywhere. They require very specific locations. For starters, they need to be located as close as possible to the various fiber optic undersea cables that crisscross the world’s oceans.

What does that do to the value of that land?

It increases in value, right? Here’s the point no-one sees: it makes the like of Amazon and co some of the world’s biggest and richest landlords.

When you place land at the centre of your research, you can clearly determine that the above is true. It changes your view of the world.

Now consider the recent earnings announcements by Google, Microsoft, and Amazon of their respective AI and cloud computing revenues. None of which happens without these data centers.

There is a powerful, almost overwhelming, desire by these vested interests that nothing inhibits or threatens this growth.

So, who will win out here. Or, more correctly, who can win here.

Governments cannot get re-elected based on a platform of bending over and letting Google, Amazon and co run roughshod over them.

It’s making “strong” action against climate change that garners votes.

Can they overcome some of the world’s biggest landlords, who, ironically enough, were vetted by these same governments to set up their data centers in their country to begin with?

Is the future of an AI powered economy now at real risk here? What about any investments in this space you own?

Are governments going to screw this all up?

Ultimately, the real estate cycle tells us who is going to prevail here.

So, it’s high time you learnt about it; start here and become our latest Boom Bust Bulletin (BBB) member.

Learn exactly how to place land at the centre of your own research to unveil the truth behind the biggest headlines in the news.

The BBB can guide you through the final years of the current real estate cycle safely and teach you how to correctly protect your investments when peak turns to bust.

We are now in the final last speculative years of the current cycle.

An almighty peak in land values awaits us.

I don’t know for sure what the ultimate outcome of this will be. But I know this.

AI is not going away. It will create enormous gains for those involved. And those gains, once they manifest, must always end up captured by the land.

So, I suggest always bet on the landowner, both here and for your own investments.

The real estate cycle suggests you are on the right trend if you do!

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.