Last week, I sent you a link to PSE Director, Akhil Patel’s interview with the market timing report on the outlook for 2024.

If you didn’t a chance to view it, you can do so here.

I highly recommend it.

This week I wanted to expand on something that really underpinned what Akhil was saying. As of 2024, despite what you may be reading elsewhere, something big is happening.

Based on my knowledge of the 18.6-year Real Estate Cycle, I too am also sensing this.

New developments that kept being announced further confirmed my hunch. And then I saw the following news, amazingly, right at the start of 2024.

Something big is coming.

For the first time this cycle in Australia, it’s finally arrived.

Homeownership without a deposit.

I saw that advert and I knew immediately that my hunch was correct. It’s all starting to come together.

The pieces are starting to fit nicely into what the history of the 18.6-year Real Estate Cycle says will happen.

And because of this knowledge, it allows me to be confident in following the ‘hidden order’ of the economy.

This is something that 99% of people are completely ignorant about. Simply because they don’t study the land market like we do.

I will continue to bring you news of these events as they occur. They can only happen at certain times of the cycle. Underpinned by the timing the ‘hidden order’ of the economy says must happen.

So, what is it all saying to us? Well, the above notice was on the front page of the “Own Home” website in Australia.

It’s selling the prospect of home ownership with no money down.

In other words, it introduces one of the first 100% mortgage products into the Australian market.

A prospective buyer doesn’t need to front up any cash to make the purchase, other than what is required to cover taxes and legal fees.

Believe me, this will be the first among many more by the time the current cycle is completed.

One of the biggest headaches, particularly for new first-time homeowners, is that – much like the Coyote’s ever fruitless chase of that fast Roadrunner (so close – and yet so elusively out of reach) – their saved deposit never seems to be quite enough to secure a loan.

The requirement keeps growing along with the ever-rising land price.

Is Own Home’s product the answer to this problem?

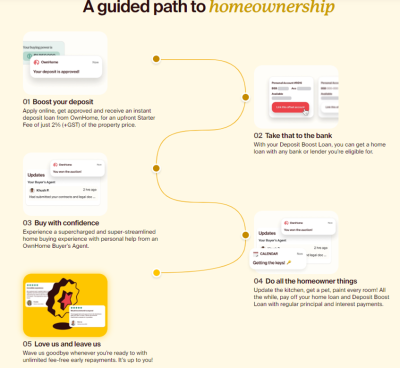

First, let’s examine just what it is. The website has a stylized image to explain the process.

In effect, you are borrowing from Own Home the deposit you need to present to another traditional bank and secure the standard 80% loan value ratio that will secure your mortgage.

They will even offer the services of an accredited buyer’s agent to help you find the right property.

Oh, and a bonus of sorts: you don’t pay any LMI (Lenders Mortgage Insurance).

I have made very clear, either via these weekly newsletters or to our valued fully paid members of Property Sharemarket Economics (PSE), one simple truth about how the land price can continue to increase.

No one, not governments, banks, or other lending institutions, property developers, existing homeowners, is interested in seeing land prices fall. They do everything they can to make it easier for you to buy a home. Particularly if you are a first-time buyer.

Because house prices are so high in relation to average wages it was clear that everyone had to address deposits first.

They would do whatever was necessary to access mortgages as easily as possible. Right alongside that are ways to help with reducing fees and making the approvals process for loans quicker and easier.

So, it’s a solution to a well-known problem. And it keeps things going in the way that the “market” wants. Ever higher house prices.

Everyone can win here – right?

Sound ridiculous? Not if you understand the land market and why the hidden order of the economy demands that this in fact happens.

Higher prices attract an ever-larger group of lenders who will now fight amongst themselves to grab market share. This competition drives innovation to make their product more attractive to would-be borrowers.

Is this not what we see here with Own Home?

Not only that, but this type of product incentivizes brokers to move their clients into these types of loans over others. Why?

A broker can secure two commissions here. One via the borrowed deposit provided by Own Home and then the remainder of the loan via whatever on-boarded bank grants you the remaining 80%.

Throw it all into the mixer and you get profitable activity – and higher land prices.

The party keeps on going. (Until it doesn’t).

Here’s a forecast for you. From this month onwards, expect to read and hear from property experts who will argue until they are blue in the face that the capital gains of 2023 for house prices simply won’t continue in 2024.

They may even suggest a large fall is imminent!

Here is where it all comes back to you, especially if you’re a first-time buyer.

This product is aimed squarely at people wanting to jump into the property market. And you may well decide that it does meet all your requirements to take that big step of homeownership.

What is the very last thing you can afford to happen should you commit?

Any fall in value for your newly purchased property. Let alone a ‘big’ fall that I predict some will call for. Remember – you are 100% geared, you have zero room to maneuver here.

For you to not end up losing your new home, a simple equation must be followed. Prices must continue to rise.

So, what is it to be? The longer you wait for a definitive answer, the more expensive those homes are going to get.

Or the experts nail it and you’ve dug yourself a debt trap you may never get out of.

The key to these products working in your favor at this stage in the cycle is seeing price rises continue; and having prepared for the fluctuations in the market that will inevitably occur.

We are now approaching the stage of the cycle where timing is everything.

And the only way to know that is to understand the cycle properly.

Here’s my recommendation to achieve the clarity you seek – become our newest Boom Bust Bulletin (BBB) member.

Every month you can personally track the real estate cycle globally and give you and your family the market edge only those who study the land markets like we do can possess.

I will work hard to research and uncover all the most notable events related to the cycle as we move ever closer to the eventual peak.

All that for $47USD a year; that’s less than a takeaway coffee a month!

Because, make no mistake, as I said at the start: something big is happening. We are on the brink of a pretty wild two to three years. Prices may rise but you need to be prepared for what’s to come.

Everyone is in on the game now. Here’s an example of the events I look for – from the other side of the world to where I am.

From the accompanying article.

Canada’s national government released a economic update a few months ago. Front and centre of their agenda was helping exsiting homeonwers avoid a ‘mortgage-cliff’ and to assist would-be homeowners via building new homes.

Mortgage-cliff. Does that term sound familiar?

Canada has already blown a $40 billion defecit in their annual budget. However, what government doesn’t turn a potential crisis (mortgage-cliff) into a opportunity to borrow more?

It is nothing short of a global credit creation bonanza. And it will all lead to something very ‘big’ happening. And that’s only the beginning.

Want to be prepared and on the right side of this trend?

You know what to do – click here.

Best wishes,

Darren J Wilson

and your Property Sharemarket Economics Team

P.S. – If you would like to receive weekly updates like this, sign up here.

P.P.S – Find us on Twitter here and go to our Facebook page here.

This content is not personal or general advice. If you are in doubt as to how to apply or even should be applying the content in this document to your own personal situation, we recommend you seek professional financial advice. Feel free to forward this email to any other person whom you think should read it.