If you would like to receive weekly updates like this, sign up here.

So, by now you may have read or heard about US President Joe Biden’s speech at the virtual leaders’ summit on climate change in Washington DC.

The motive behind this was to encourage the so-called “world’s worst polluters” to speed up their transition to greener energy sources.

Now, the key to this has always been how to come across as not being “you talk the talk but don’t walk the walk” in such speeches, particularly if you are the US or China.

Simply because such countries are themselves the worst polluters! (On a per capita basis Australia is even worse than them).

Naturally, the world’s media latch upon that very speech to create some juicy headlines.

I found the one below in the Australian Financial Review (AFR).

Source – AFR

Source – AFR

This is because investors believe that solar panels and companies making them will obviously be big winners here.

So, does that mean you should sell the farm and plow everything last cent into such companies?

Not so fast!

Read on, as I will show you, yet again, the simple yet effective technique that can save your precious capital from bombastic click-bait news headlines such as the one above.

And I will guide you to another area of green energy into which your capital may be better deployed.

Thank you for changing the direction of mine and my families lives. You have permanent subscribers from me and mine, and friends from Ontario Canada for life as well! You are bringing people out of ignorance and danger of the banking/land cycle, what a service to humanity!

Thank you for everything so far, and I am excited to ride with you all into the future!

Josh – March 2021

Ignore the headlines: do this instead.

Now don’t get me wrong, the premise here makes a lot of sense on paper.

And if you continued to read the aforementioned AFR article you would have seen further confirmation of such.

“Shares of Enphase Energy, SunPower and SolarEdge Technologies jumped as much as 8 per cent, 6 per cent, and 10 per cent respectively…”

Well, that’s compelling. How can you argue with those facts, Darren?

Actually, it’s quite easy. As always, I read the news and pull up a stock chart for confirmation.

I pulled up charts for 17 solar companies listed on the US stock indices. There may be more out there but for our purposes today I think that number is adequate.

Frankly, I don’t need to see more, their charts are pretty much identical.

Let’s look at the 3 companies quoted above.

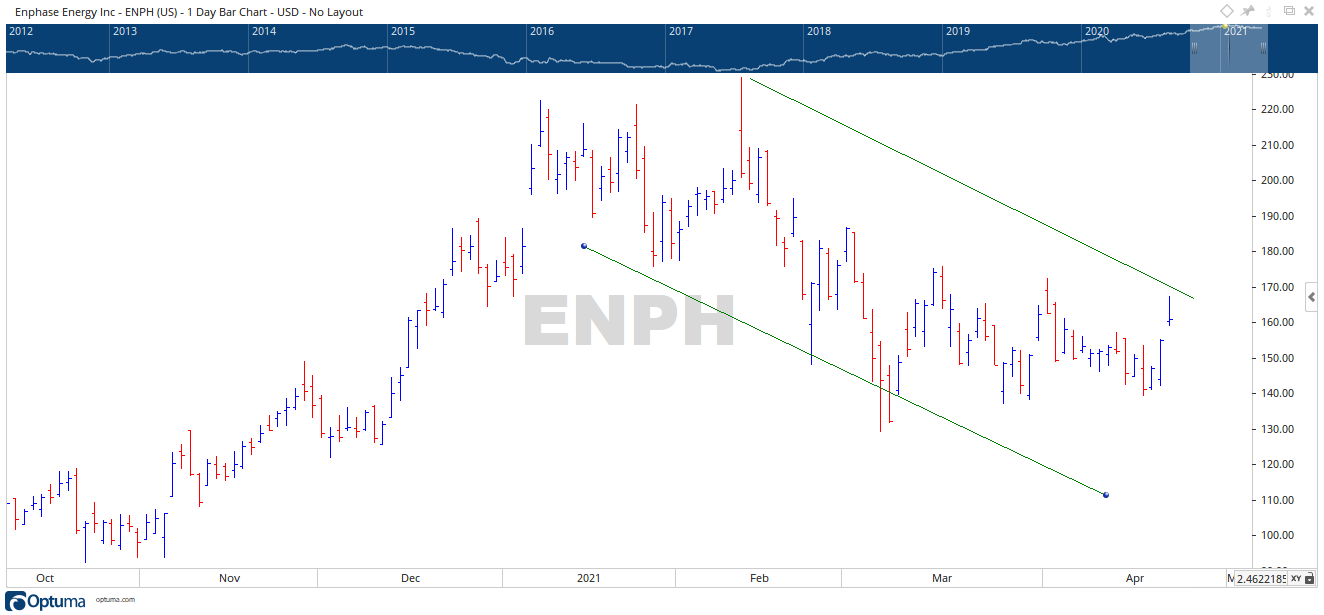

So, here are the charts for Enphase Energy (NASQ – ENPH), SunPower (NASQ – SPWR) and SolarEdge Technologies (NASQ – SEDG) respectively.

I have added simple trendlines to help make the below point.

Any entry in these stocks this year would see you underwater in a hurry. You are investing against the trend. You know the trend is down because the price action is putting in a series of lower highs and lower lows.

You cannot create wealth for yourself and your family this way.

Does this mean solar companies are a dud investment moving forward? Of course not! These companies could very well outperform in this sector in a few years.

Here is my point: instead of taking to heart news headlines and throwaway comments about stocks going to the moon, simply bring up a chart.

Trust me, all 17 stocks I researched look exactly the same as these ones.

What you want to see, be it now or in the future, is a trend line moving up – higher lows and higher highs – indicating the market sees increasing earnings for these companies and is pricing them accordingly.

Then, you research and find the key time and price resistance levels where you can make an effective and safe entry.

Not only are you protecting your scarce capital, but you are investing it efficiently in those stocks that will be going up immediately.

Without such confirmation, to invest today is a losing proposition. At worst, you will be made to wait before you see any profits.

Here is another way to benefit from the green energy revolution.

Here’s s a little fact that most have missed. It basically never gets spoken about during speeches and debates about green energy sources.

And yet, every developed country that has signed up to an internationally recognized climate treaty have acknowledge they cannot meet their mandated targets without it.

And that’s nuclear energy.

Now, you may have a small, or large, concerns about this form of power and think it has no future.

But that’s the cool thing about facts. They don’t care what you or I think.

Solar power, hydrogen, these are the cool terms to use when imagining a future free of carbon-based energy. And rightly so.

They will definitely play their part when we get there. The hard part is what do we use in the meantime before we get there? And that is why nuclear energy simply must be involved.

So, if you were disposed to get some exposure this year in green energy sectors then I contend these are the type of charts you look for.

Here are two companies that mine and process uranium. Do I really need to tell you where the money was made between them and the solar companies in 2021?

For those interested in further research, the top chart belongs to Paladin (ASX– PDN) and the bottom one is a US based company called Comeco Corp (NYSE – CCJ).

These charts speak for themselves: note the trend, higher lows and higher highs. The hype and all the talk about solar company X and Y jumping so-and-so % is specifically designed to elicit an emotional response from you.

And as I’ve shown, action based upon such emotions would see you losing money.

Whereas a different mindset, one that looks objectively at the status quo, and research to determine the truth of such statements, would assist in protecting capital to be deployed in sectors that are trending up.

And it’s this exact mindset that we aim to help develop and teach to those who take up a membership of the Boom Bust Bulletinm Bust Bulletin.

As a member you will learn the history of the 18.6-year Real Estate Cycle, why it continues to repeat to this day, and how best to spot and take advantage of the opportunities the cycle presents as it turns.

You will also learn how to read headlines like the one we spoke of today using a real estate cycle lense, how to find what “isn’t” said and then to apply the correct technical set ups on a stock chart to profit.

All for a few cups of coffee a year. Or a solar panel perhaps?

Don’t leave your journey to financial freedom on spurious headlines, get educated, apply your knowledge and win.

Sign up now now.

Best wishes

Darren J Wilson

and your Property Sharemarket Economics Team

P.S – Find us on Twitter under the username @PropertySharem1

P.S.S – Go to our Facebook Page and follow us for right up to date information on the 18.6-year Real Estate Cycle.